The income statement template is one of the key financial statement used by all companies either small or large. Income statements are an important part of doing business. At first, they seem overwhelming but soon you will appreciate the valuable information they provide for your company.

Table of Contents

- 1 What is an income statement?

- 2 Types of income statements:

- 2.1 Simple/basic income statement

- 2.2 Single-step income statement

- 2.3 Multi-step income statement

- 2.4 Pro forma income statement

- 2.5 Common size income statement

- 2.6 Contribution margin income statement

- 2.7 Absorption costing income statement

- 2.8 Variable costing income statement

- 2.9 Partial income statement

- 2.10 CVP income statement

- 2.11 Segmented income statement

- 2.12 Comparative income statement

- 2.13 Projected income statement

- 2.14 Consolidated income statement

- 3 What to include in an income statement template?

- 4 How to prepare an income statement?

- 5 Important terms to understand for income statements:

- 6 The uses of an income statement template:

- 7 The benefits of an income statement:

- 8 Conclusion:

- 9 Frequently Asked Questions (FAQs)

What is an income statement?

An income statement indicates the income and expenses of a company over a particular period of time. It is used by investors and business managers to identify the profitability of the company. Moreover, it is one of the three key financial statements required by Generally Accepted Accounting Principles (GAAP).

Types of income statements:

Let us discuss below different types of income statements;

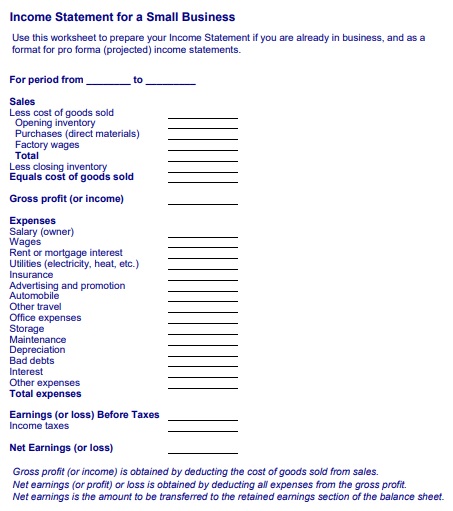

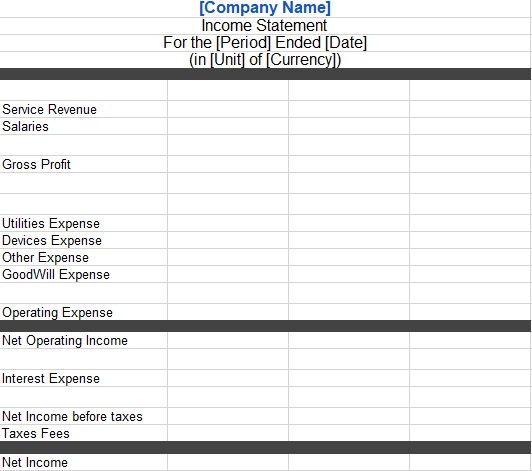

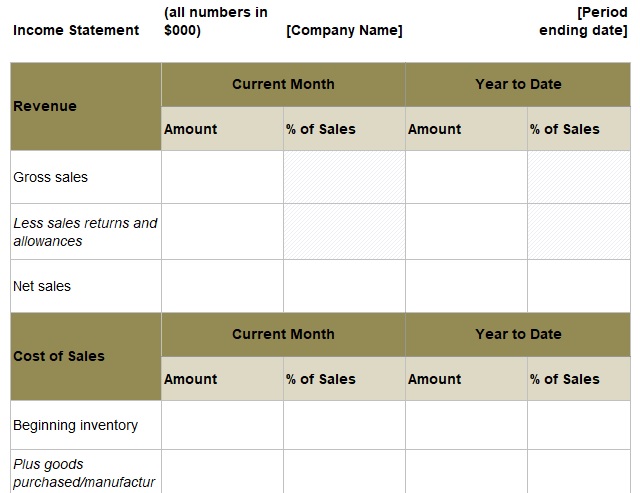

Simple/basic income statement

This type of income statement just contains the income, expenses, and net profit or loss. Small businesses usually use simple income statements for internal reporting.

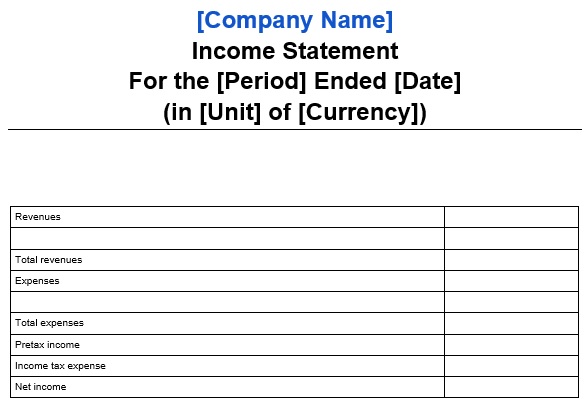

Single-step income statement

It is a basic income statement that contains all revenues together, followed by all expenses together, and as the closing line item net profit or loss. Both small and large companies are often used these income statements. However, they only give a general overview of the company’s financial position.

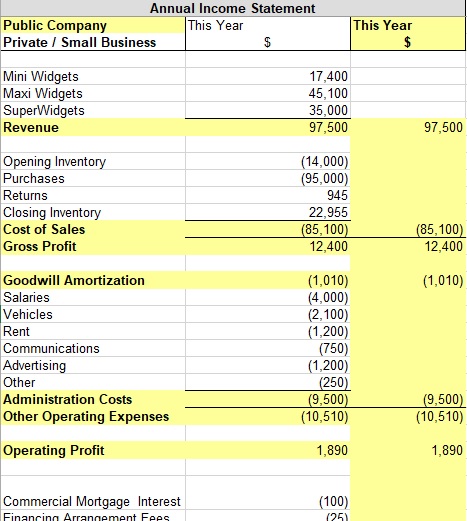

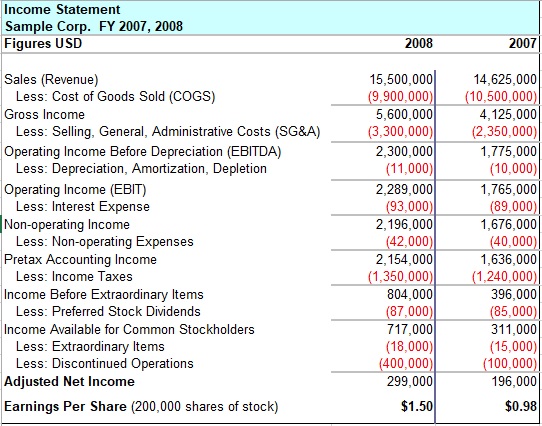

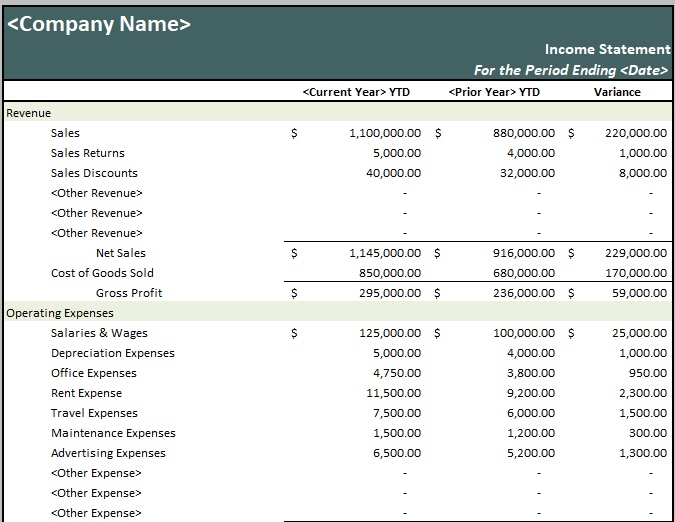

Multi-step income statement

It is more complex than a single-step statement. The multi-step income statement provides a more thorough overview of the company’s financial position. Operating and non-operating are listed separately by having these statements. As individual line items, gross profit, operating income, non-operating income, and net income balancing figures are included.

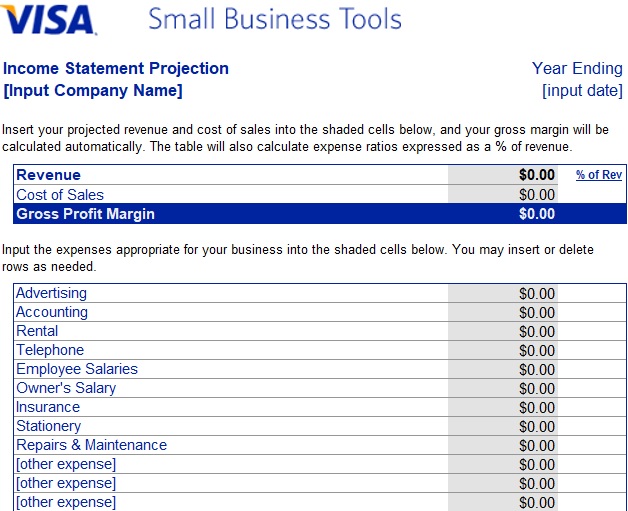

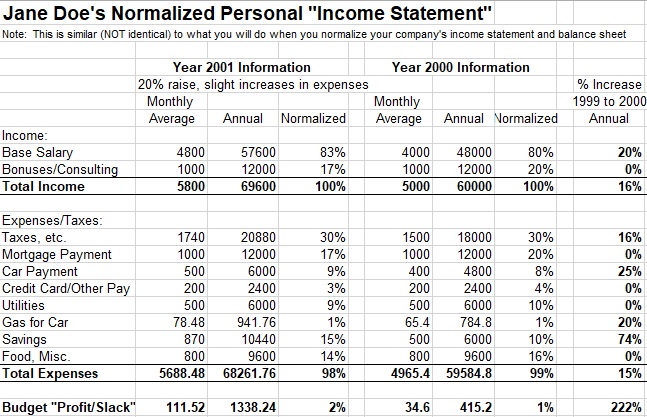

Pro forma income statement

A pro forma income statement depends on projections or possibilities. They are used to forecast what may happen in anticipation of an event.

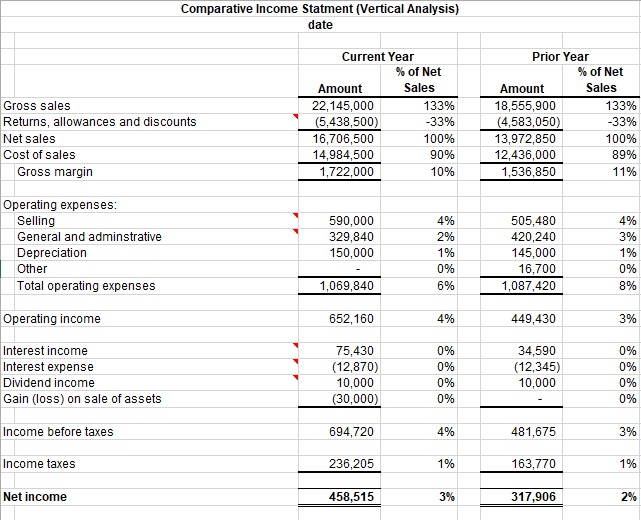

Common size income statement

This type of income statement is used to determine how each separate item on an income statement affects the company’s overall profit. This income statement is used primarily for inspection.

Contribution margin income statement

It is commonly a tool for planning and analyzing product costs used for internal reporting. This statement is helpful for analyzing a company’s “break-even” point.

Absorption costing income statement

Absorption costing is basically the standard format for income statements. According to GAAP, it is the required format for external reporting. All manufacturing expenses are referred as part of product costs with absorption cost.

Variable costing income statement

For internal reporting of financial statements, companies sometimes use variable costing. By having variable costing, only direct costs are referred as part of product costs. While the remaining is considered periodic expenses. Furthermore, they are deducted from the gross profit for that period.

Partial income statement

This is a special type of income statement. It just reports financial information for a specific period of time. The term partial doesn’t indicate the information provided within the income statement. This is because these income statements generally report all the same information as a full income statement.

CVP income statement

CVP or Cost-Volume-Profit income is a specialized internal financial statement. They are used to analyze the profitability of various production scenarios. It generally contains fixed expenses, variable expenses, revenue, and contribution margins. However, the format may vary from one company to the next.

Segmented income statement

Likewise the standard income statement, a segmented income statement indicates the same information. This type of income statement is generally prepared to identify the profitability of a certain segment of a company.

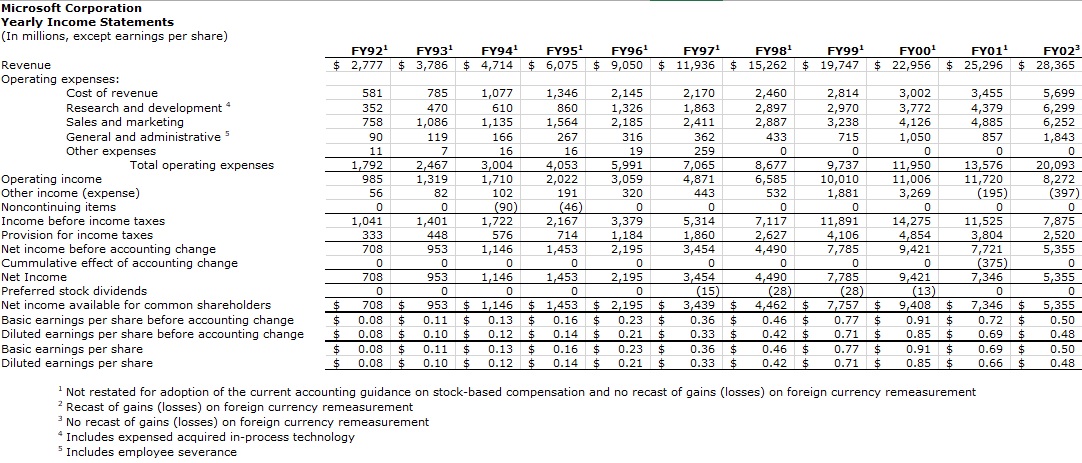

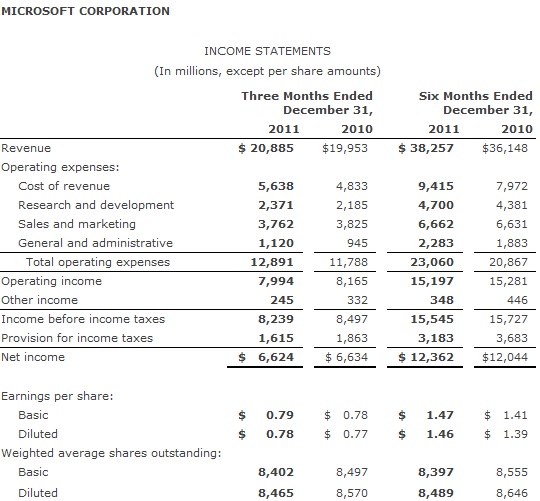

Comparative income statement

By using separate columns for easy analysis, this income statement compiles income statements for multiple periods into one document.

Projected income statement

It is used for budgeted purposes. It uses projected figures for a future period rather than using historical numbers from a certain period of time. It is created like a pro forma income statement but it is not the same type of document.

Consolidated income statement

The consolidated income statement is prepared by a company with subsidiaries. It indicates an overview of the entire company’s financial position as a whole.

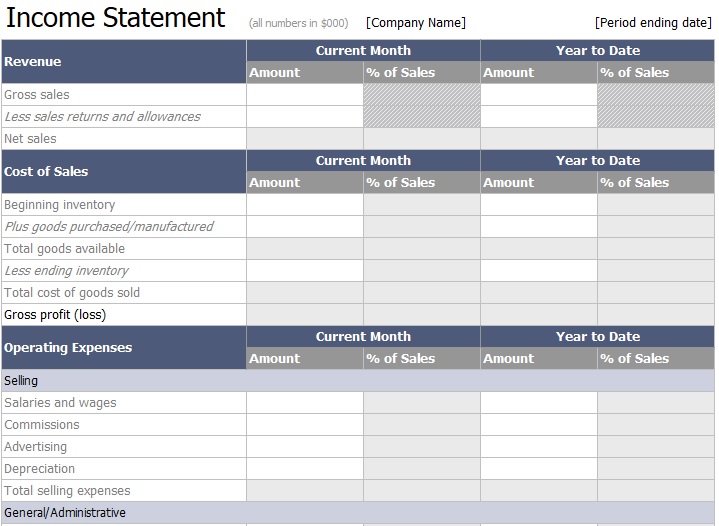

What to include in an income statement template?

According to GAAP, the income statement should be clear and concise and include the following;

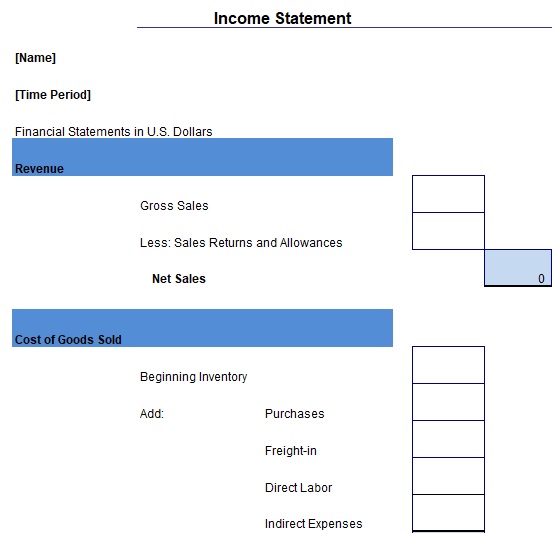

Revenue

During the stated period, revenue is the income a company receives. This should contain income from all sources.

Expenses

It contains any cost the company experiences during the stated period. This involves the Cost of Goods Sold (COGS), operating expenses, and more.

Gains/losses

From non-operating activities, gains and losses are also included. These are typically investment-related activities.

How to prepare an income statement?

There are two way to make an income statement;

Single-step income statement

Companies usually use a single-step income statement that has three main sections;

- Revenues: at first, the company’s revenue should be summarized and totaled.

- Expenses: after that, all expenses should be listed and totaled.

- Net income: in the bottom line of the income statement, specify whether the company had a net gain or a net loss. This is known as net income.

Multi-step income statement

Operating revenue and expenses are separated from non-operating revenue and expenses by having a multi-step income statement. For gross profit, a multi-step income statement also includes a line item. The multi-step income statement has the following sections;

Sales

- The total sales of the company

- The Cost of Goods Sold (COGS)

- The resulting gross profit

Operating expenses: all of the operating expenses of a company contain Selling, General, and Administrative Expenses (SG&A).

Operating income: it is the difference between gross profit and total operating expenses.

Non-Operating/Other: non-operating expenses may contain revenue, expense, gain, or loss.

Net income: it is calculated as a total of operating income plus non-operating income.

Important terms to understand for income statements:

Income statement formula

The income statement formula is given as;

Net Income = Revenue – Expenses

According to Generally Accepted Accounting Principles (GAAP), it is a requirement for a business to use the accrual method of accounting. This indicates that the expenses that occur in every month, the revenue should be matched with them.

Relationship to cash flow

The accrual method shows that in the income statement the statement of cash flows is not directly linked to activity. No matter when cash moves into or out of a business, every month revenues and expenses are posted.

Operating and non-operating income

A single-step income statement is produced by using an income statement formula. But, most companies use multiple-step income statements so that their business outcomes would be analyzed in more detail. They use it to separate operating income and expenses from non-operating income and expenses. It is important to analyze operating income separately from non-operating income. This is because it is requirement for a business to have a consistent operating income in order to be successful over time.

The uses of an income statement template:

Every business on the market definitely wants to make profit. So, they must have a mechanism that assist them in identifying whether it is making profit or loss. They should make use of an income statement template so that your accounting department identify the total amount of profit that your business has incurred for the specific period.

Furthermore, with the help of income statement, the accounting team also determines the expenses incurred to operate the company. Thus, the difference between revenues and expenses at the end of the day will be used to identify whether a business has made profit or loss.

The benefits of an income statement:

An income statement is a beneficial tool for the businesses who want to determine the health status of your business. Health status indicates how much worth your business is. After identifying health status of your business, you can decide whether you should make more profit by making some changes or you are making sufficient profit from the business.

In addition, you can also know about a business forecasting with the help of income statement. It is basically a technique that provides you an exact guess about your business future. Also, you should make sure that every financial period, you don’t have consistent result. This is important to make variation in the figures from time to time. Hence, to flourish your business, you should work hard and make more profits.

Conclusion:

In conclusion, an income statement template is used to display the summary of expenses and incomes of a company over a particular period of time. The balancing figures of the income statement state the result of business operations (profit/loss).

Frequently Asked Questions (FAQs)

The overall financial performance of a company for a specified period of time is indicated by an income statement. This financial document proves very beneficial for analysis and planning of all aspects of the business. It is made for both internal and external reporting. This financial statement provides the best overall view of the company’s financial health status.

On the single-step income statement, it is listed under ‘Expenses’. While, on the multi-step income statement, it is found under ‘Operating Expenses’.

On a single-step income statement, it is found under ‘Expenses’ and on a multi-step income statement, it is listed under ‘Operating Expenses’.

The amount of information provided by the multi-step income statement is its main advantage. This income statement for clearer analysis separates operating income from non-operating income.

The subtotals appear on the multi-step income statement in the following order;

1- Gross profit

2- Operating income

3- Other revenues and expenses (non-operating)

4- Net income

You can find them under operating expenses listed as individual line items.