An investment tracking spreadsheet is a helpful tool used by investors to keep a record of the value of their investments over time. For your company or your personal investments, if you have to monitor the investments then using an investment tracker makes the task easier.

Table of Contents

- 1 The advantages of using an investment tracking spreadsheet:

- 2 Why do you require an investment tracking spreadsheet?

- 3 By using investment tracking spreadsheets, track your investments:

- 4 Other types of financial tracking spreadsheets:

- 5 How to use the investment tracking spreadsheet?

- 6 Why should you track your investments?

- 7 Conclusion:

- 8 Faqs (Frequently Asked Questions)

The advantages of using an investment tracking spreadsheet:

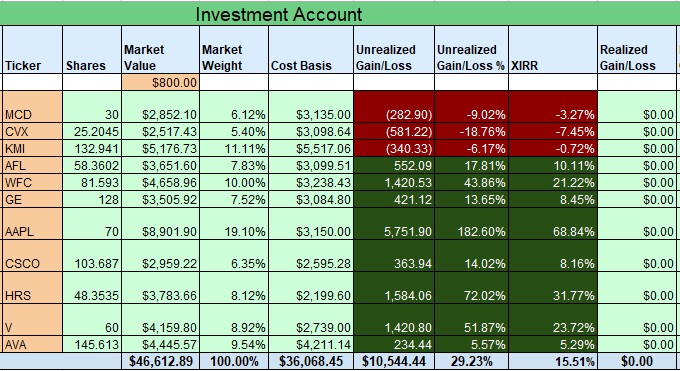

An investment tracking spreadsheet is a simple and highly effective tool and all types of investors can get benefit from it. To measure the progress of your investments against your financial objectives, you should use the stock portfolio tracker Excel. This provides you a good grasp on;

- The money you own

- Where you have invested your money

- The performance of your investments

Moreover, this document makes you able to have a single location to store all of your essential investment data. Below are the advantages of using this document;

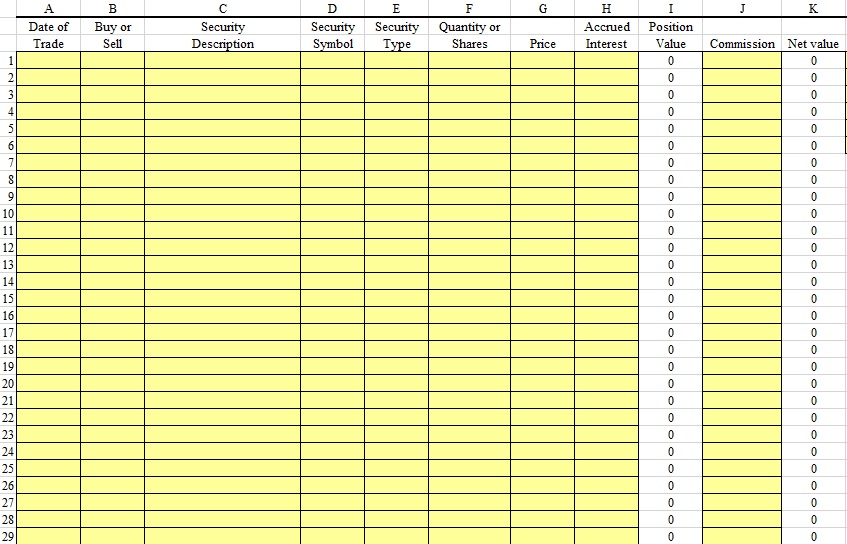

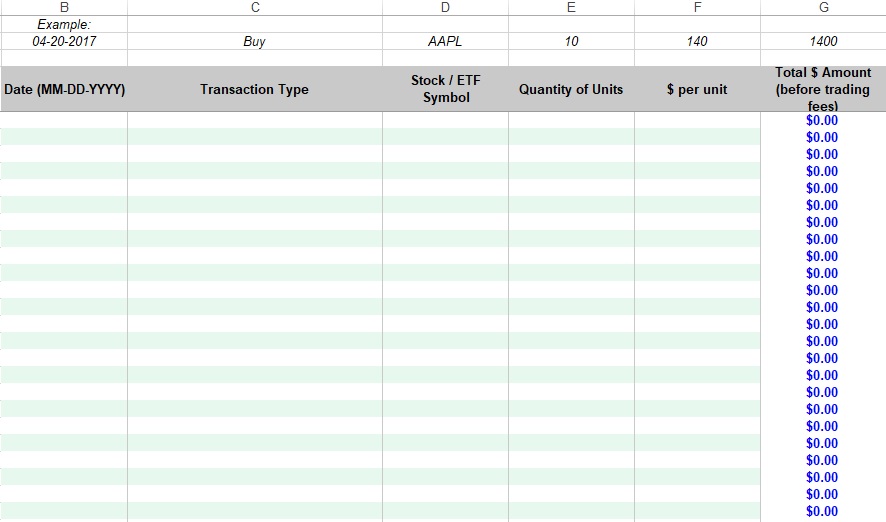

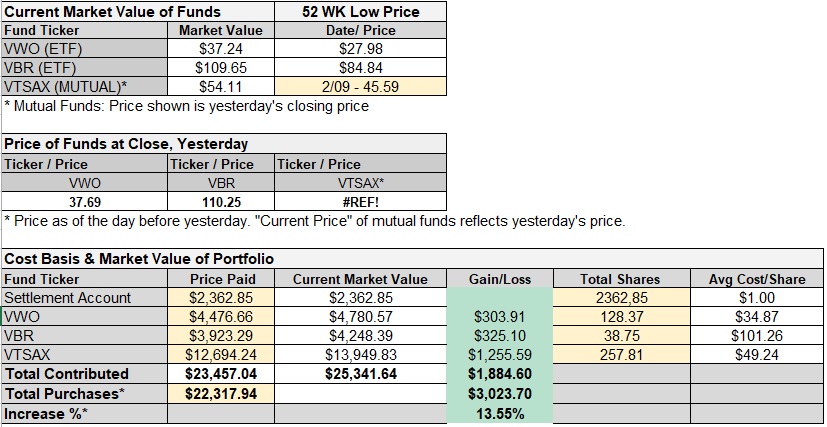

- An investment tracking spreadsheet indicates you the whole record of your purchases, sells, dividends, return of capital transactions, and splits.

- You can use it as a reference if you need to make any financial decisions.

- For entering data, using an investment tracking spreadsheet is very easy as it performs calculations automatically.

- You can arrange the information on the spreadsheet into categories. Doing this, make it easier for you to understand the status of your investments.

- It helps you in keeping record of your assets not just locally but any international assets and investments as well.

- It makes it easier for you to perform rebalancing.

Why do you require an investment tracking spreadsheet?

This spreadsheet is considered as one of the most versatile and easiest ways to understand and keep record of the entire performance of your investments. In this current era, everyone can become an investor but there are various ways and places to invest. Moreover, you should stay on top of everything if you have a lot of investments. Here are the reasons that why you require an investment tracking spreadsheet;

To keep all of your investment information in one place:

You should keep an investment tracking spreadsheet if you have a number of investments. Another way is you can monitor each of your investments separately and this can be very time-consuming. In terms of your investments, it enables you to get an overall picture of your financial health.

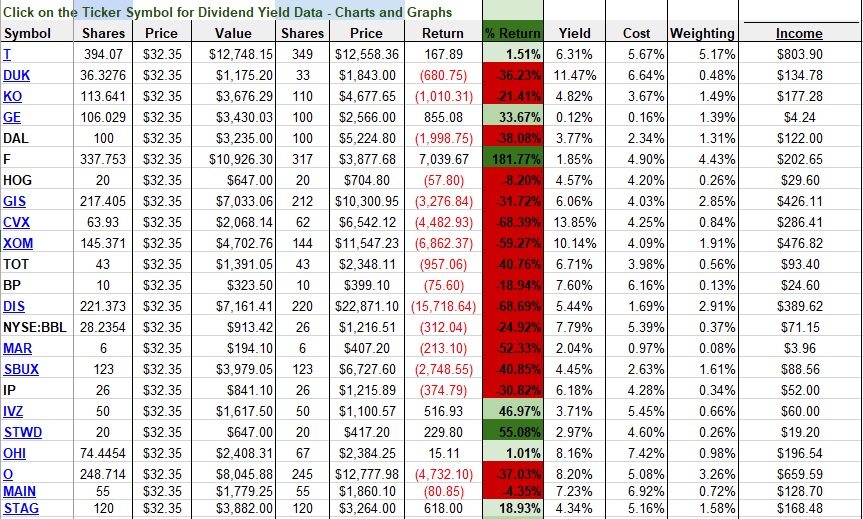

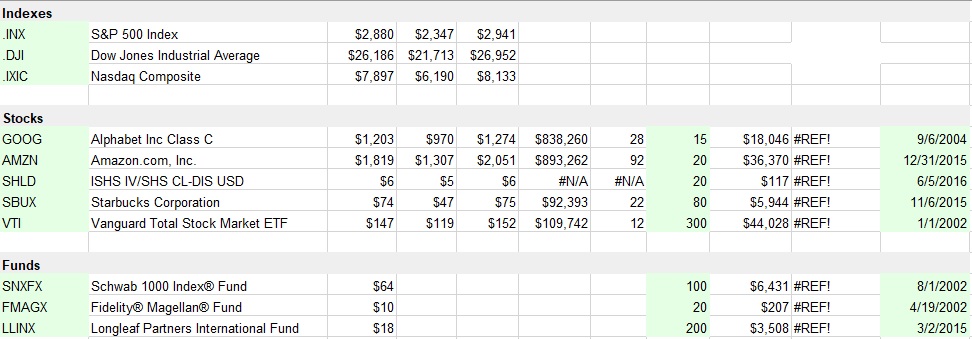

To assess the overall performance of your investments against benchmarks:

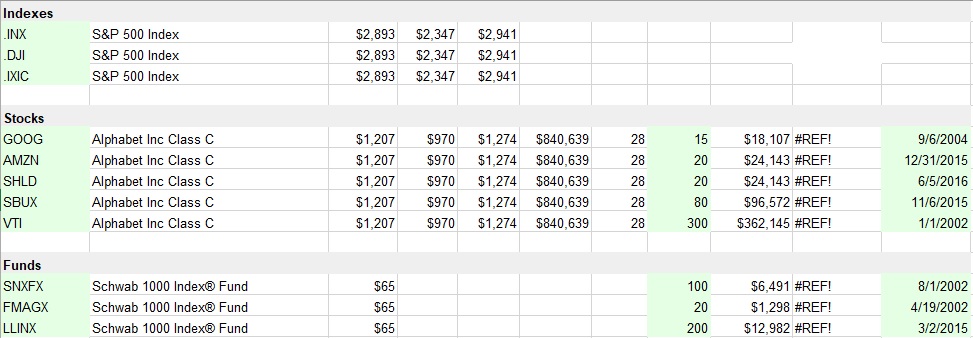

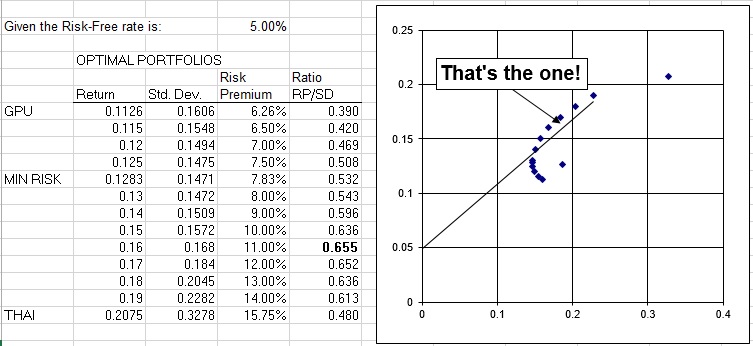

The best way to assess the overall performance of your investments is to make use of benchmarks. If your investments remain the same or decrease and the benchmark you are using increases for a couple of months or even years then you have to re-think your strategies.

In addition, there are different types of benchmarks available for use on the basis of what types of investments you have in your investment tracker. These benchmarks develop an index that depends on different information according to the stock mix within it. This way, they become well-rounded representations of the industries they pay attention to. It doesn’t matter how well your investments perform you just have to maintain a healthy perspective. You should always bear in mind that the market will always go up and down. Therefore, you should constantly keep record of your investments via a spreadsheet. This makes it very simple and easy for you in the long-run.

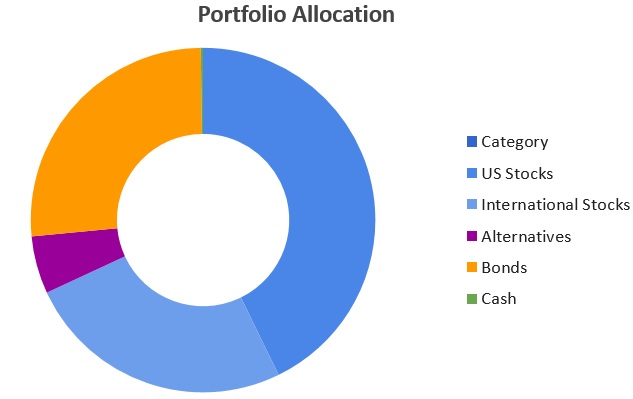

During planning your investment strategies, it is easier to assess the allocation of your assets:

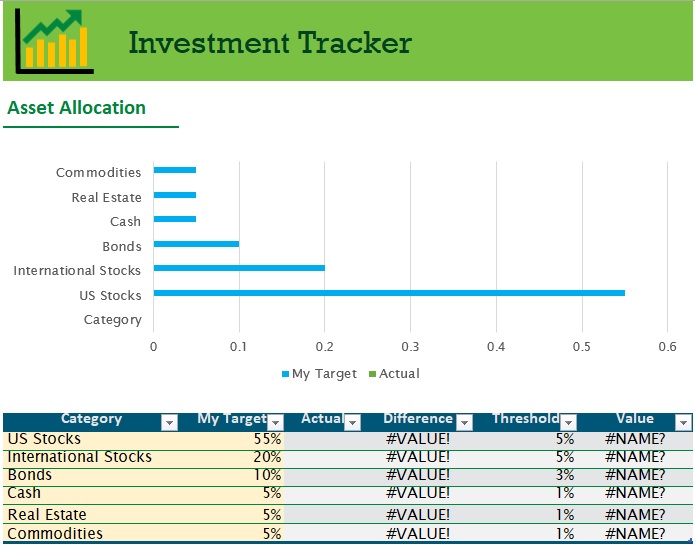

Asset allocation means how you categorize your assets and place them into your investments. The type of asset grant to select would largely base on your objective for investing. This objective also assists you in identifying the aggressiveness of the asset allocation you are targeting.

To plan your investment strategies, use the information on your investment Excel template. Once you identify your asset allocation target, you should use the information on the spreadsheet in order to make comparison among your desired allocation against your actual or current allocation. This assists you in making more informed decisions in terms of your investments.

By using investment tracking spreadsheets, track your investments:

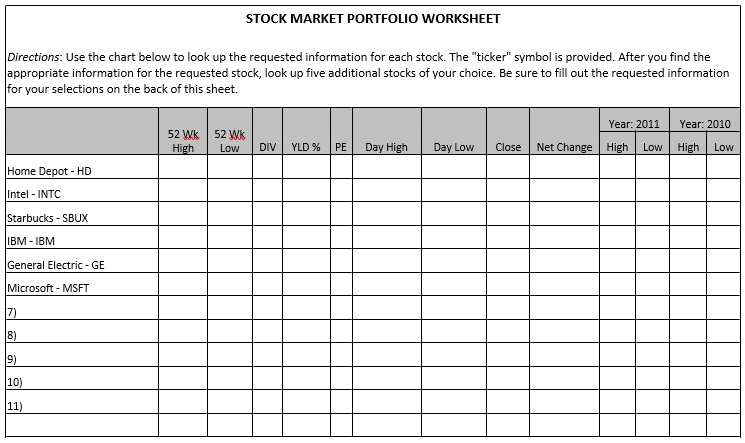

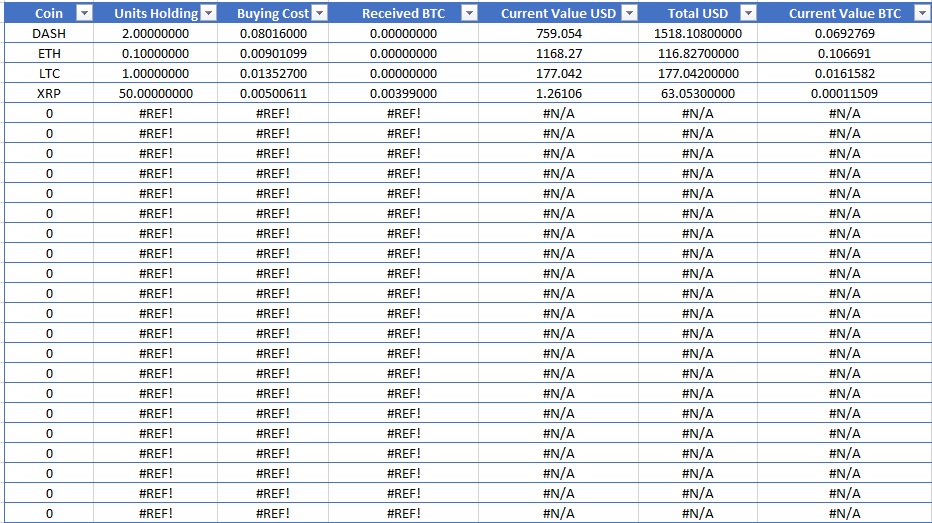

Creating investment tracker is the best thing to do in case you want to take control of your investments and keep track of everything. You should use the following spreadsheets to track your investments;

MS Excel

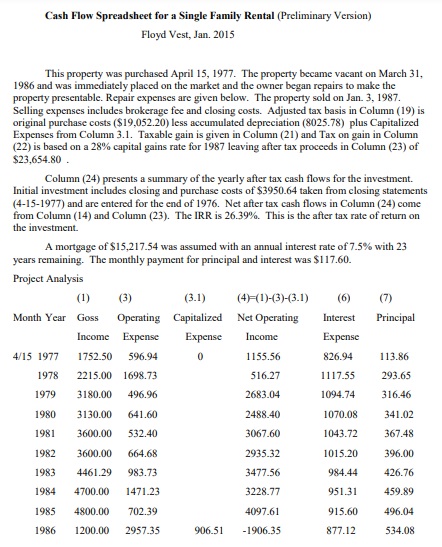

You should make use of MS Excel to calculate or map out your dividend schedule. It is also used to keep track of the cost basis of taxes on your individual lots.

Google spreadsheets

Make use of Google spreadsheets if you want that the information present on your spreadsheet automatically update with the information from public finance sources. Likewise MS Excel, it isn’t powerful but you can access it from anywhere.

Other types of financial tracking spreadsheets:

It is important for any investor to accurately and easily visualize their financial health. You should use an investment tracking spreadsheet that enables you to know where your money is at all times. Some other types of financial tracking spreadsheets are;

Family budget planner:

Starting a family refers to keep record of a lot of financial information such as car payments, children’s tuition fees, mortgage, and so much more. So, you should create a planner to provide you with the financial awareness.

Personal monthly budget spreadsheet:

You should take control of your budget each month. With the help of budget spreadsheet, you can have a better idea of where you can save, which expenses you can take out from your budget, and so on.

Holiday spending budget:

You should have a holiday spending budget if you want to plan to take a trip at this time or you want to go shopping with your loved ones, etc.

Travel budget worksheet:

If you love travelling then one of the best ways to do this is through a travel budget worksheet and considers your costs all the time.

Income statements template:

This document declares that the amount of your earnings and the amount of money you spend.

Savings goal tracker:

For a lot of people, saving money is very challenging but savings goal tracker makes this task much easier. It monitors how much you save monthly, quarterly or yearly.

Other financial trackers are;

- Credit Repair Spreadsheet

- Wedding Budget Spreadsheet

- Donation Tracker

- Price Comparison Template

- Money Tracker

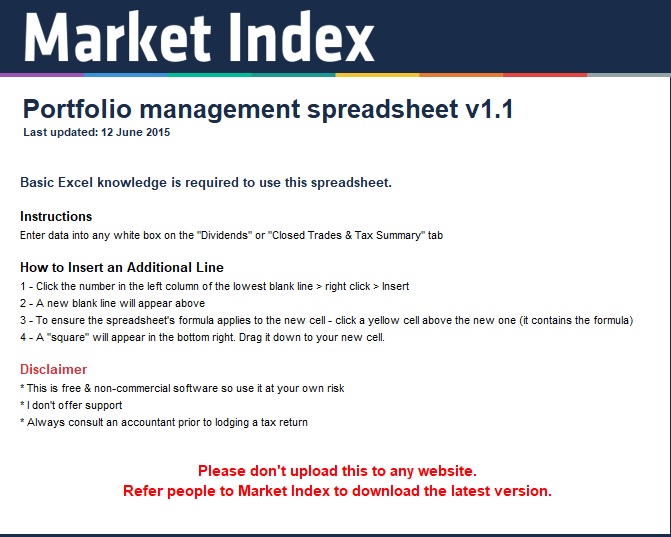

How to use the investment tracking spreadsheet?

Consider the following tips to get the most out of the spreadsheet;

- You should update your investment data on daily basis. You can get an accurate image of your investment performance.

- In order to know some different features of the spreadsheet, you should take some time.

- To automate some of the tasks, you can take advantage of the macros in case you are using the investment spreadsheet for Excel.

Why should you track your investments?

Track your performance over time is the most important thing to do when it comes to investing. This way, you can see whether your investments meeting your expectations or not. Also, you can make adjustments to your portfolio by having this information. When you track your investment performance, it makes you able to identify patterns and trends. You can make more informed investment decisions when you focus on these patterns.

Conclusion:

In conclusion, an investment tracker template is a highly effective tool that accurately and easily visualize your financial health. An investment tracker is the best tool to take control of your investments and keep track of everything. By using MS Excel or Google spreadsheets, you can easily track your investments.

Faqs (Frequently Asked Questions)

The most important investment data that you should track are your investment returns, portfolio value, and risk level.

You should update your investment spreadsheet at least once a week so that you can get an accurate picture of your investment performance.