Good budgeting and planning make you able to reach your spending and saving goals. Even people don’t know a way to manage their personal finances. However, the household budget worksheet helps them a lot in managing their finances. With the help of this worksheet, you can work out a proposed household budget in a better way. This worksheet also allows you to compare your monthly budget with your actual income and expenses.

Table of Contents

What is a household budget?

A household budget is a planner that helps you to identify how your monthly income should go each month. Basically, financial planning always starts with a household budget. The budget tells you how to spend your monthly income each month. You can also make a plan for savings with it. It allows you to track your spending and savings, and monitor and achieve your financial goals more easily.

The importance of household budget worksheet:

Most importantly, it helps you in saving your money. You can get an idea of your expenses by using this budget worksheet. The worksheet enlists the areas where you are spending most. Thus, spending less on the monthly budget in that particular area can save a lot. It also makes you able to keep your budget on track.

Moreover, a budget worksheet informs you about the debt you owe someone. To improve the credit history, it’s important to know how much loan is overdue and how to overcome the debt. Using a worksheet is the best start because it helps you to determine how you are spending your money. It also informs the ways by which you can reallocate your money. It also determines what your needs are. Hence, by determining all this information, you can manage your monthly budget more effectively.

The elements of a household budget worksheet:

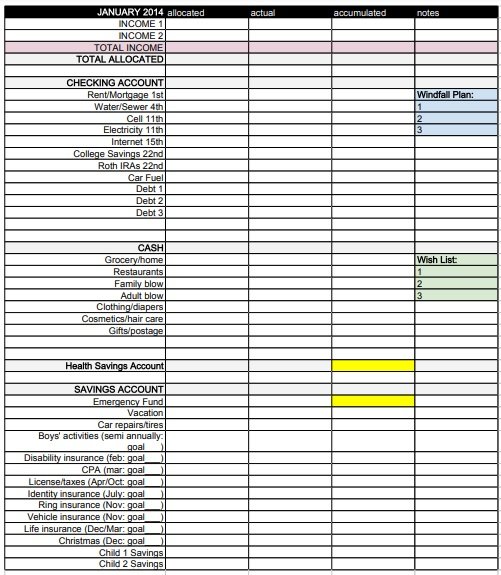

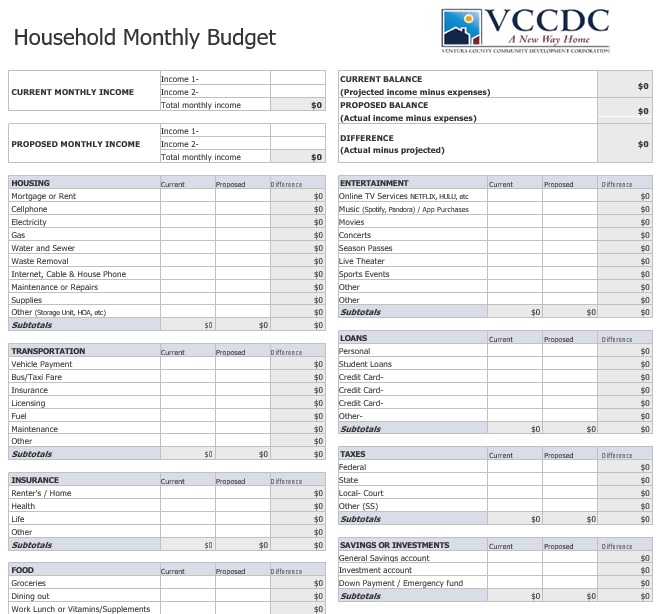

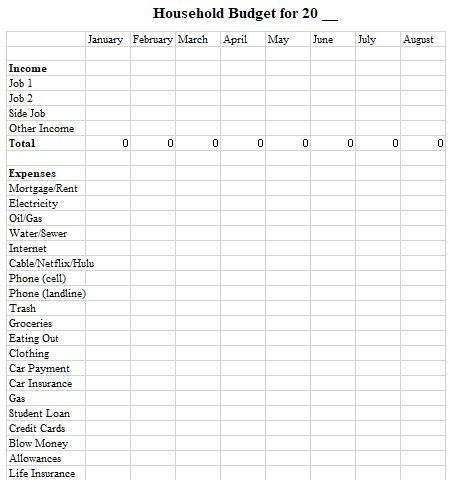

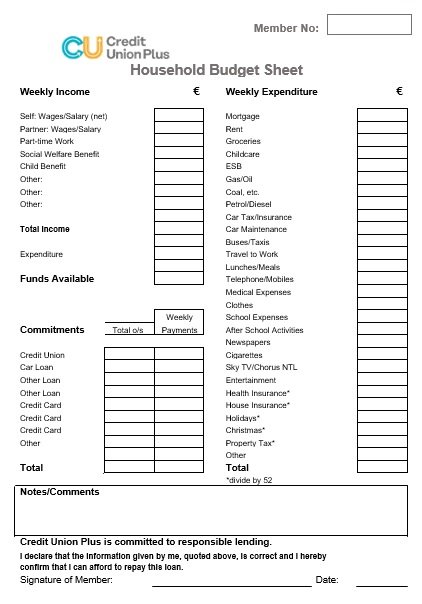

A household budget worksheet includes the following elements;

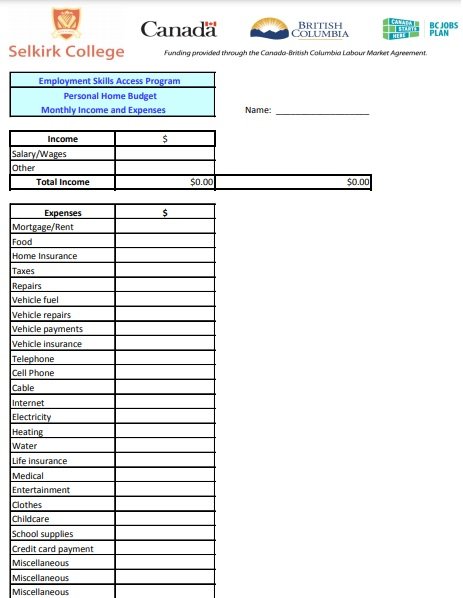

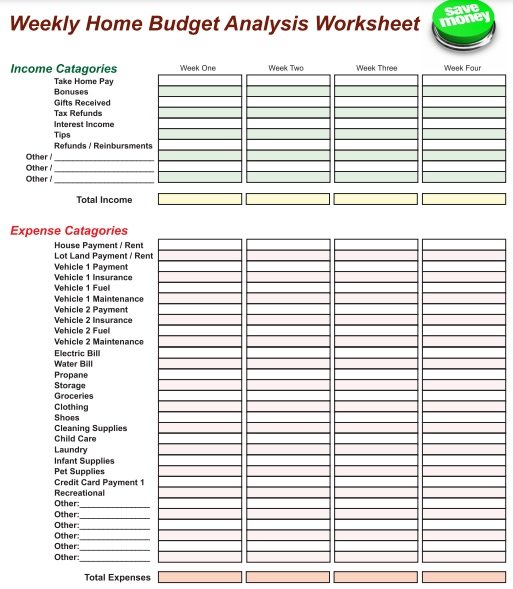

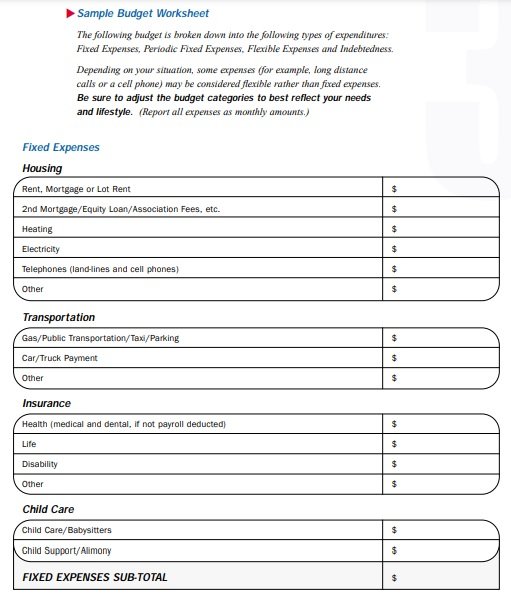

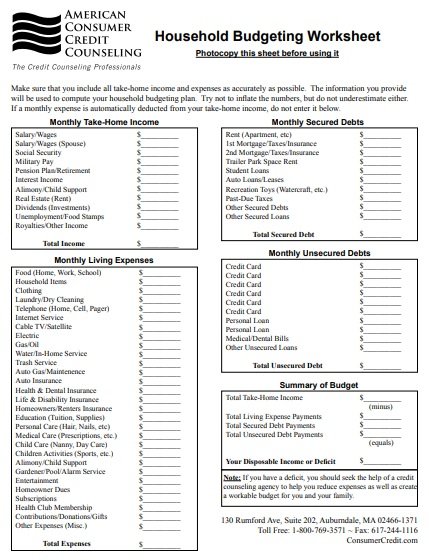

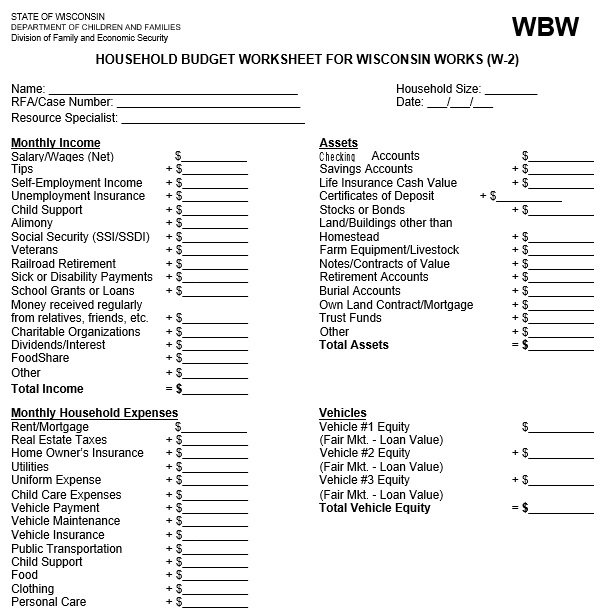

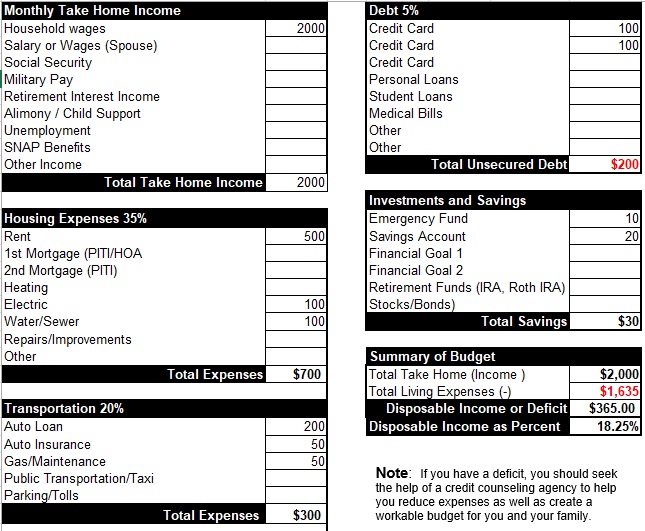

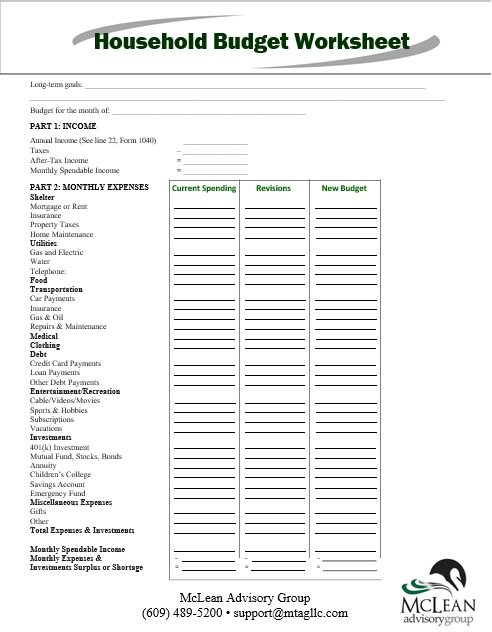

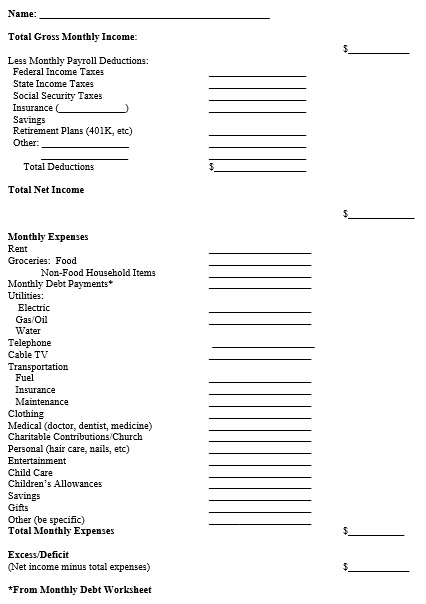

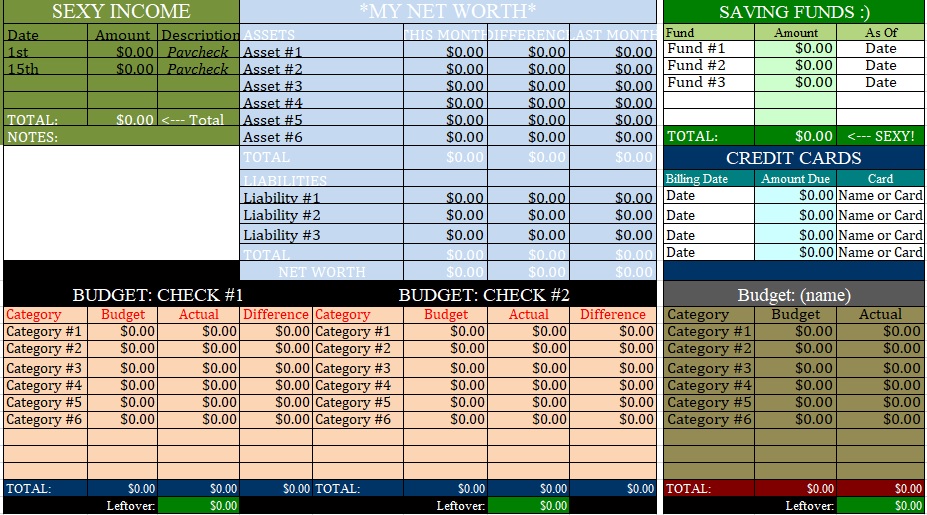

Income

The income that you earn from all sources in the month is included in this section. The actual figures are also mentioned along with the expected figures. With these figures, an individual can determine the variance between budgeted and actual figures.

Expenses

To analyze the budget, the expenses of an individual are further classified into significant expenses. These may include the following;

- Daily household expenses

- Utility expenses

- Transportation

- Miscellaneous costs

- The amount assigned against the savings

Balance

After deducting all the expenses, obligations, and savings from the income, it will indicate the remaining balance with an individual.

Creating a household budget:

Let us discuss step-by-step how to create a household budget;

Step#1:

At first, determine the amount of money you have come each month. This is the first step in creating a household budget. During making a budget, if you keep your salary in mind then it becomes easy what you have to spend. From your total salary subtract social security, taxes, and flexible spending account allocations. Then, the amount left is called your net income.

Step#2:

The next step is to categorize your spending so that you can know where you have to make adjustments. In this way, you can realize that where you are spending the most money and from where you can save it. Then, enlist all your fixed expenses such as your monthly bills. However, you can’t save money from them but it can be helpful to know how much of your monthly income they take up.

Now, write down the variable expenses i.e. the expenses that can change from month to month like groceries, entertainment, etc. From these expenses, you have an opportunity to save money.

Step#3:

Before going to transfer the information you have tracked, write down all the financial goals (short-term and long-term) you want to achieve. Short-term goals take no more than a year to accomplish. On the other hand, long-term goals may take years to achieve such as saving for retirement or a child’s education, etc. Bear in mind that never set your goals in stone. However, it’s important to determine your priorities before planning a budget.

Step#4:

By compiling your variable and fixed expenses you know what you will spend in the coming months. You can accurately determine how much you have to budget with the help of your fixed expenses. When you are trying to predict your variable expenses keep in mind your past spending habits. Additionally, you can also break down your expenses further between the items you need to have and the items you want to have. This difference will help you in making adjustments.

Step#5:

When you have all done with the above steps it’s time to complete your budget. The thing you have to do is to write down your income and spending on a household budget worksheet. By doing this, you can see easily where you have money leftover and how you can cut back so that you can save money to achieve your goals.

Step#6:

If you want to stay on track then review your budget on regular basis. Some elements of your budget remain the same but some may increase, you may have to reach your goal, or you may have to plan for a new one.

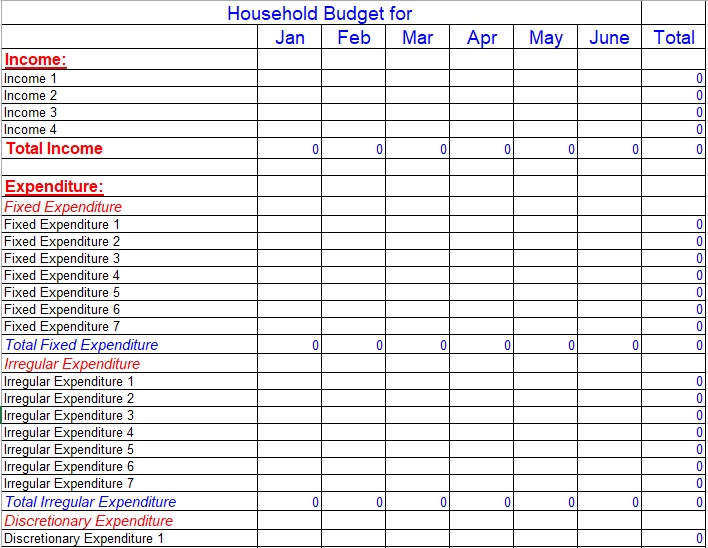

How to use monthly household budget template?

Let us discuss below how to use this template;

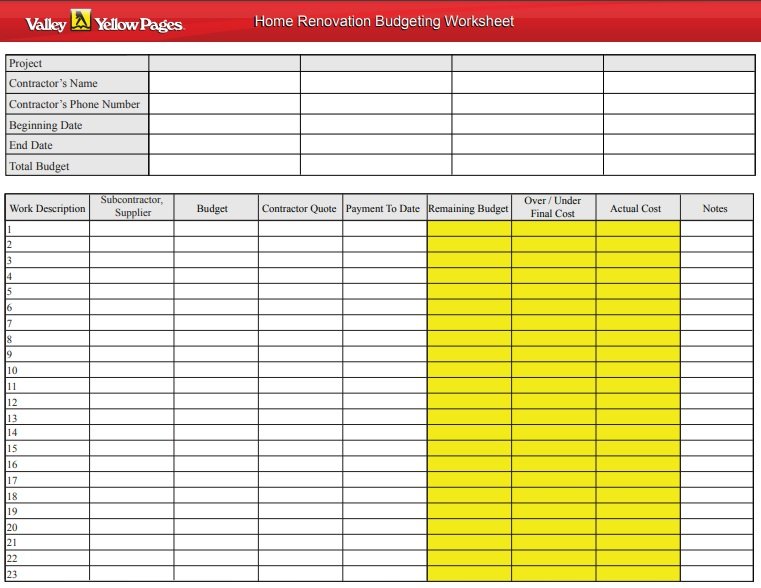

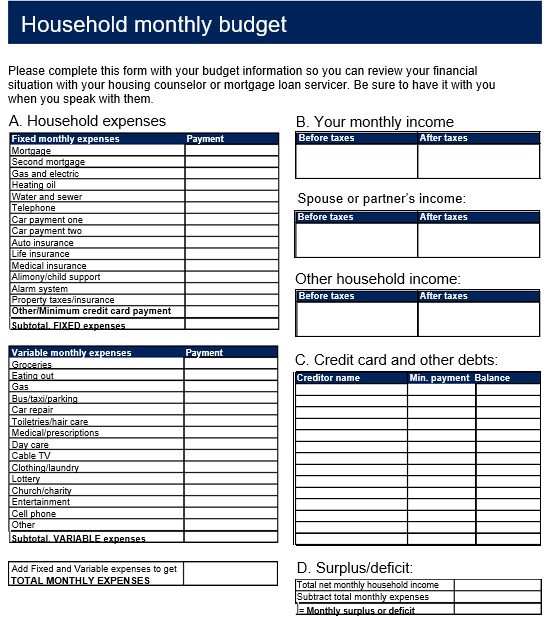

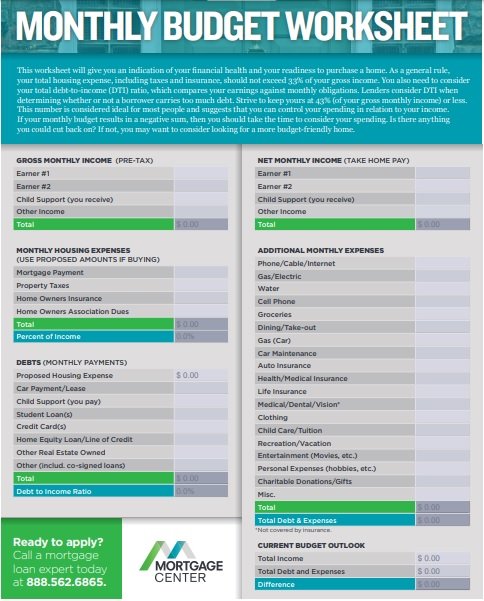

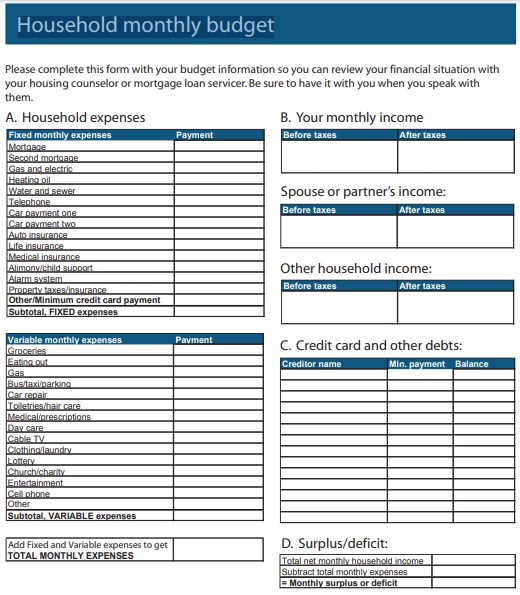

- First, you have to download the monthly home budget template online. After downloading the template, enter all the necessary details such as your name, the number of family members involved in the budget, the month, and many more.

- When you are done filling up the required information, you have to enter all the details of the expenses you incur in the month as well as the budgeted amount against those expenses. Additionally, provide your income from all the sources during the month in the template.

- The general household expenses may involve expenses on daily household things, utility expenses, debt obligations and more. Also, you can keep some money apart from expenses as savings.

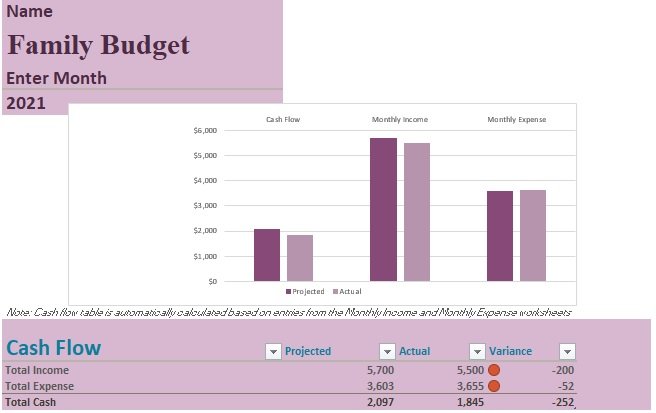

- In order to get the balance left at the month-end, your expenses and savings are deducted from the total income. Due to pre-applied formulas, this balance will be calculated automatically.

- Along with the balance figure, the template will automatically calculate the variance among each item. You can get a precise picture of the household’s budget at the top of the template.

Benefits of household budgeting:

Household budgeting provides you amazing benefits such as

- A budget makes you able to have 100% control over your money. It is the best way to control your money as it helps you to understand where your spending habits are weakest. In addition, you can live your life with less stress without having to worry about the unexpected expenses that come up.

- You can track your financial goals easily. Most importantly, it assists you to avoid spending on unnecessary things that make it difficult to achieve your financial goals.

- Budgeting helps you to identify where your money is coming from, where you have to spend it, and how much you have at the end of each month. It can give you a thorough understanding of your finance.

- Furthermore, it informs you what you can afford and how can you lower your debt. It also helps you to make your spending organize.

- When serious issues can occur in your life such as unemployment then it will allow you to be prepared for it. In short, budgeting acts as a ‘safety net’.

- Above all, it helps you in living your life peacefully.

Conclusion:

In conclusion, a household budget worksheet allows you to create your monthly budget in an organized manner. With the help of this document, you can manage your personal expenses easily and can live a peaceful life. For making a budget, you just have to input three things i.e. monthly income, name of expenses, and information on making the limit to each expense.

Faqs (Frequently Asked Questions)

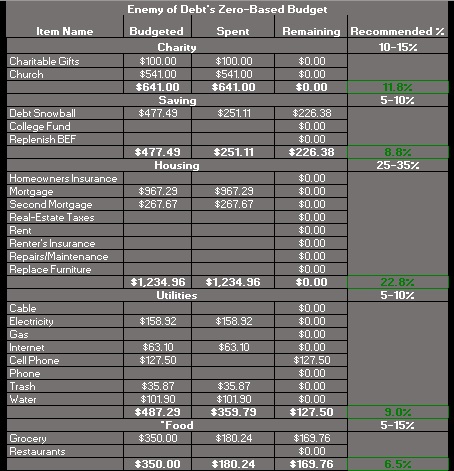

A budget where your income and expenses are balanced is referred to as a balanced budget. A zero-based budgeting approach is a way to implement a balanced budget.

Your overall wealth can get increased because of the following;

1- You limit your spending

2- Save more income to reach your financial goal

3- Initiate investing

4- Develop a debt repayment