You have to follow several steps while composing a collection letter template. To give your customers a formal notice that they owe a debt, it is important to use appropriate language. Generally, before seeking help from a professional collection agency, you would have to send more than a single debt collection letter.

Table of Contents

Types of collection letter templates:

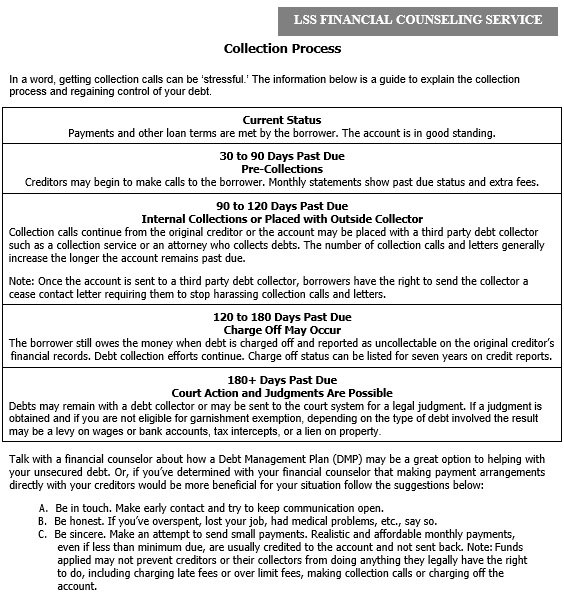

There are four different types of collection letter templates. The first two types of collection letters have a lighter nature. On the other hand, the last two letters are usually more assertive. Let us discuss them below;

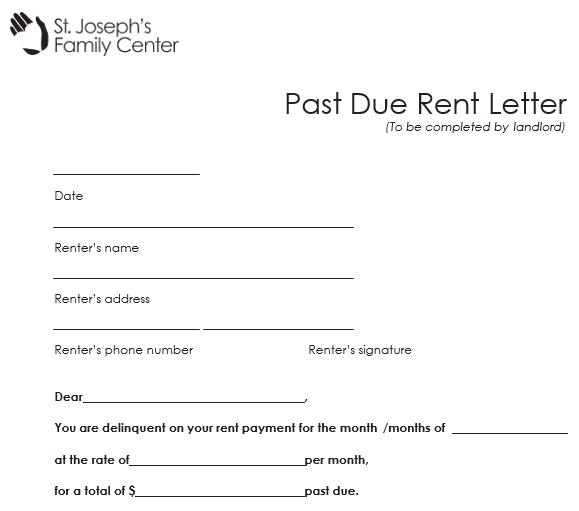

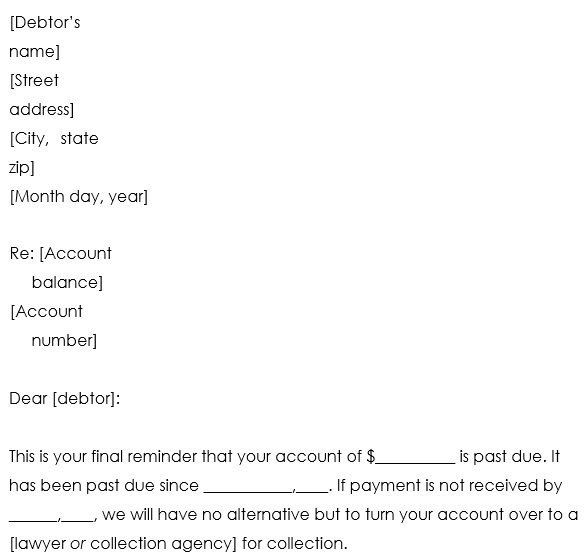

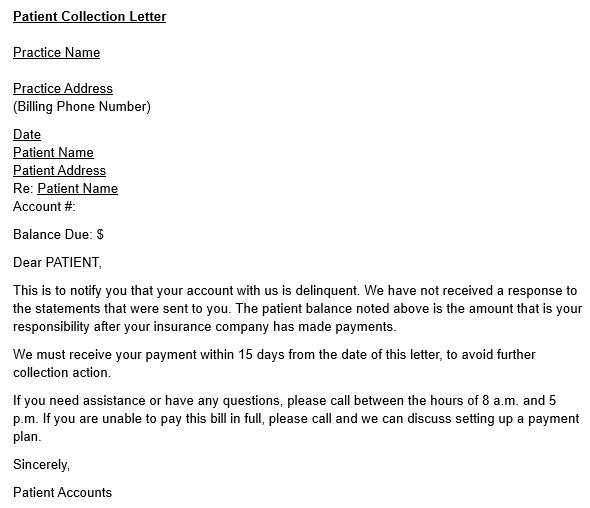

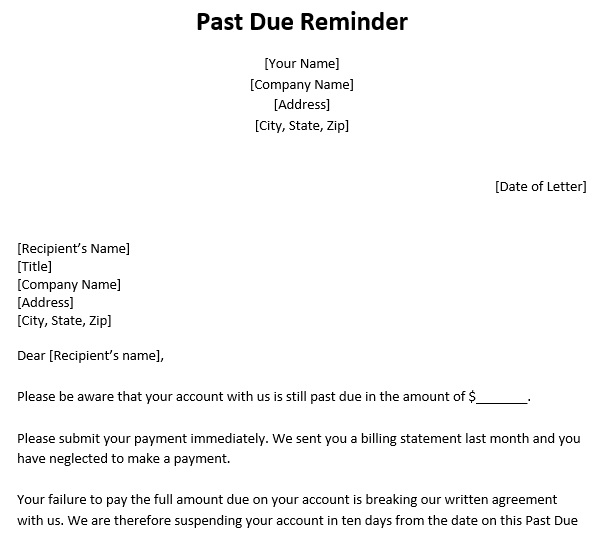

First collection letter

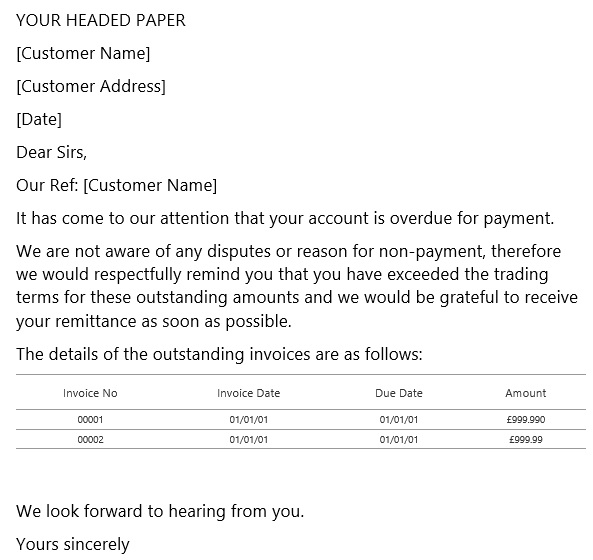

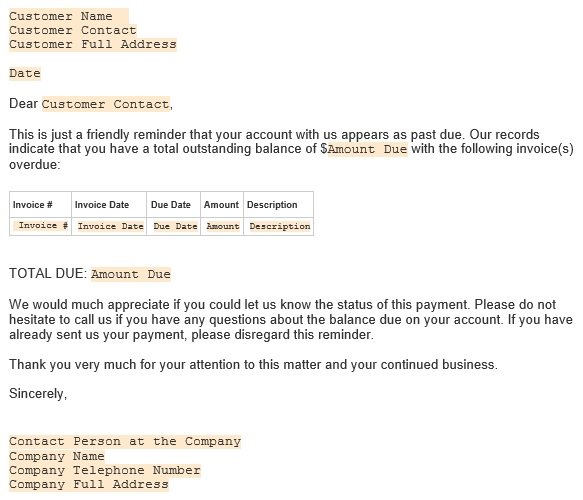

When you have tried emailing or calling the customer already, you should only send this first past due letter template. You can use accounting software that sends automatically email reminders to customers. But, it’s time to send this first letter after your first attempts at reaching your customers and they don’t reply or make the payments. Typically, at least 14 days just after the due date of the invoice, you should send this letter. You should print the letter on your company’s letterhead to make it more official. The company’s letterhead contains your business mailing address and logo. You may also like business reference letters.

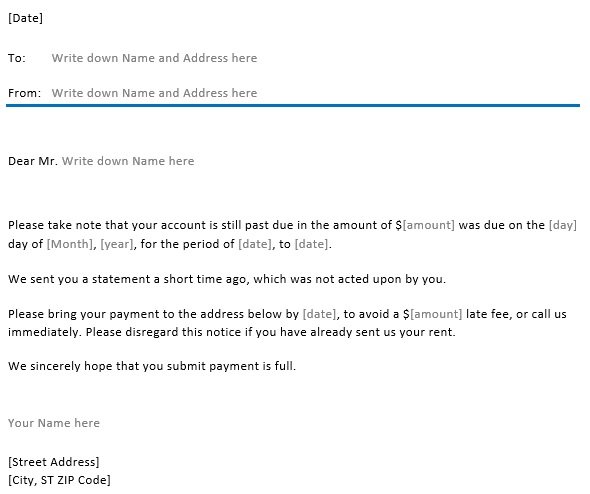

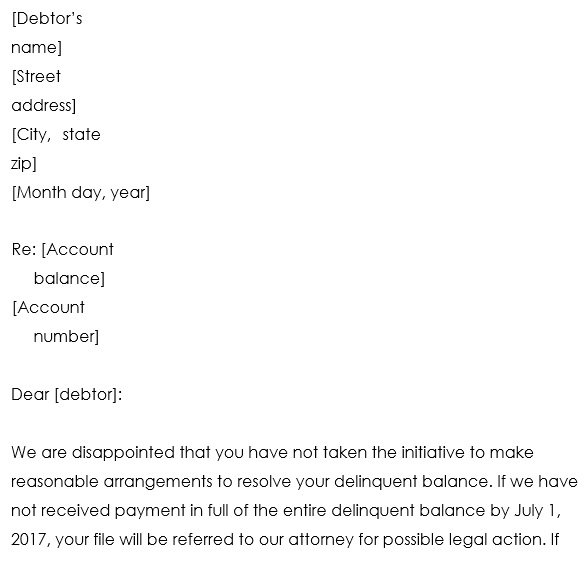

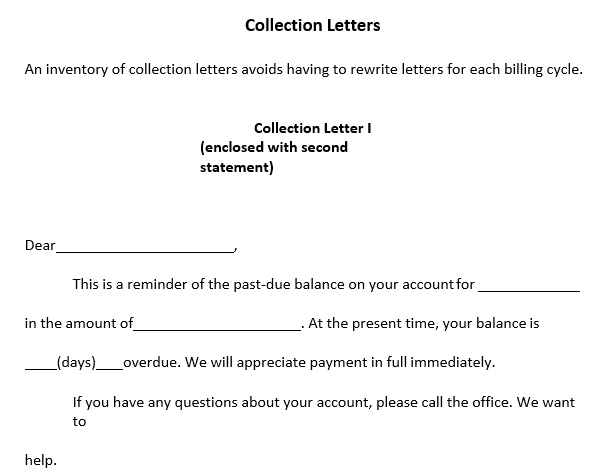

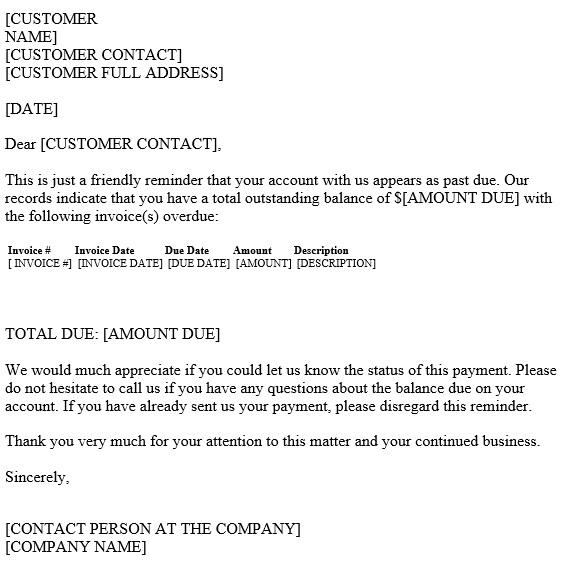

Second collection letter

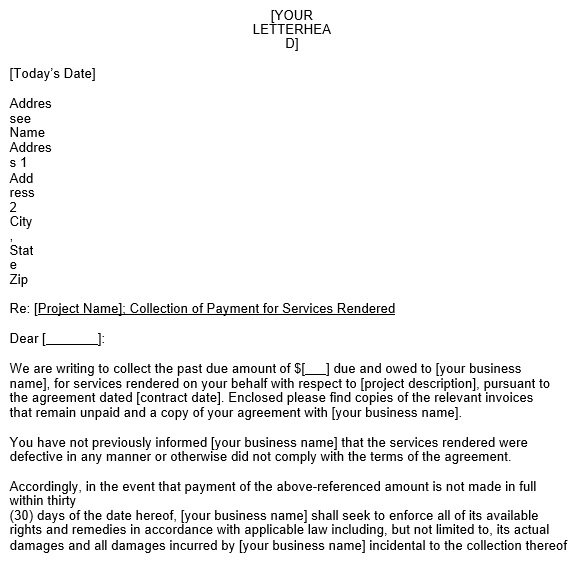

You should try to contact with your customer again via phone or email before sending this letter. Ask the customer whether he received the first letter or not and if he would already want to make the payment. Hence, it’s time to send the second debt collection letter in case your attempts prove unsuccessful.

The main difference between first collection letter and second collection letter is that you will show that you’ve tried to reach your customer y composing the first collection letter. Likewise first one, compose this letter on the company’s letterhead that includes your business mailing address and logo.

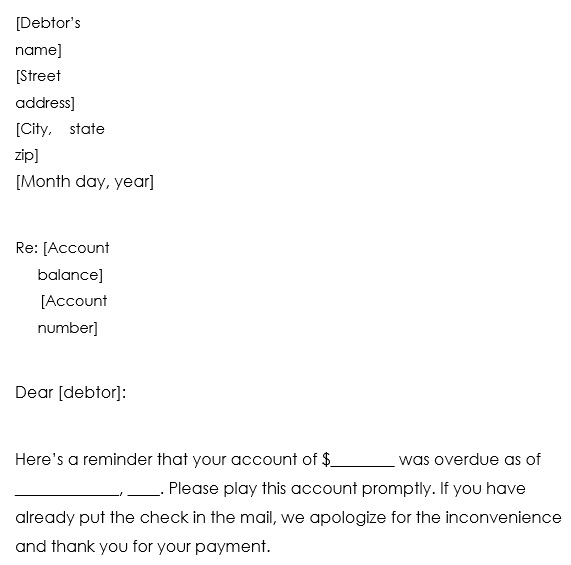

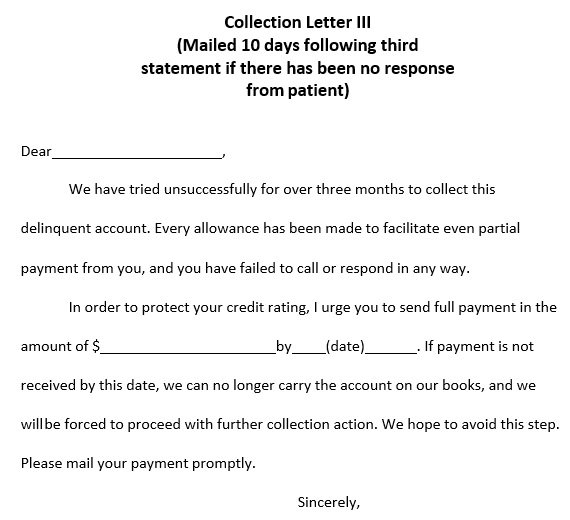

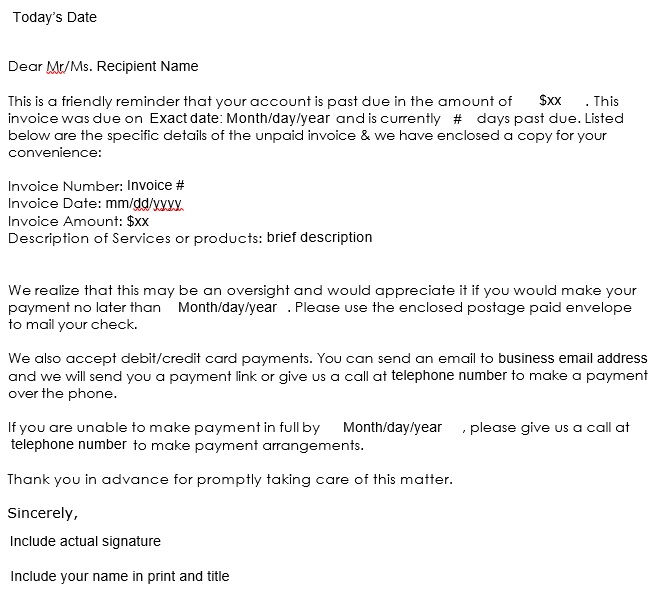

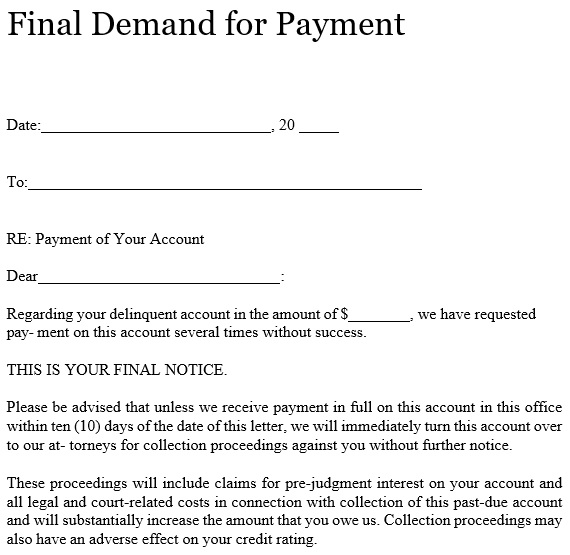

Third collection letter

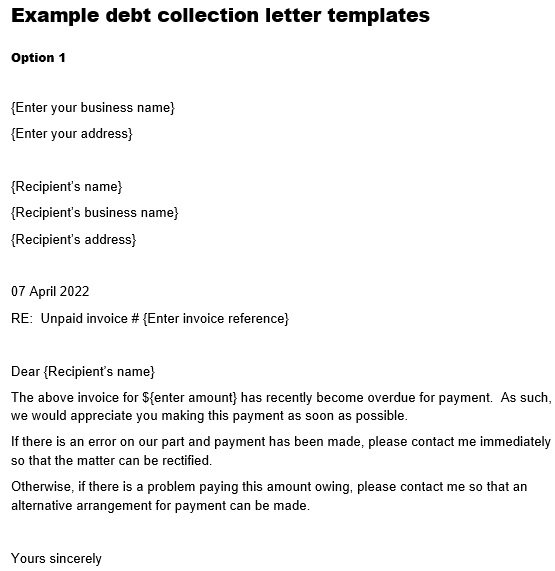

You should try to give your customer a call after sending the second letter and some time has passed. However, in case, you aren’t able to contact the customer and he hasn’t tried to communicate with you for weeks, you should send the third collection letter template.

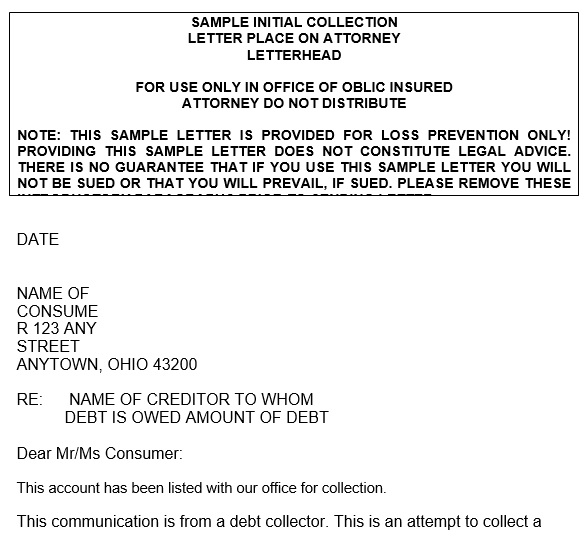

Likewise the second letter, you should indicate that you’ve tried to open communication with the customer with the help of first two letters. Explain in detail how you’ve tried to reach the customer through the phone but remain unsuccessful. It is also suggested to send this letter through certified mail. The best thing about the certified mail is that the customer will have to sign for it. That way, you have evidence that the customer received the letter. This letter is an important piece of documentation if you want to take legal action against the customer.

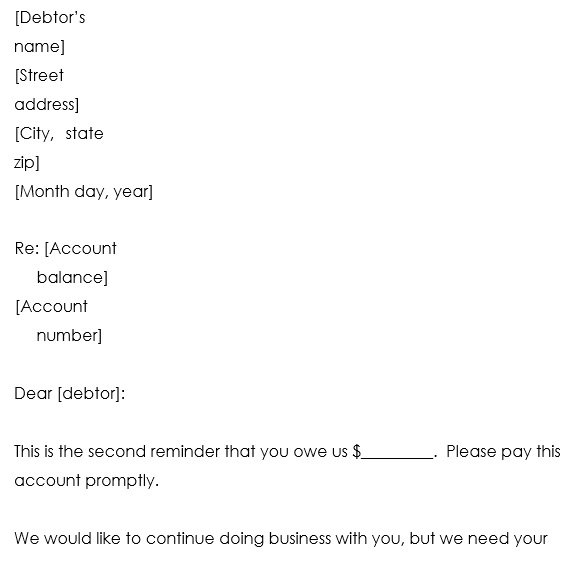

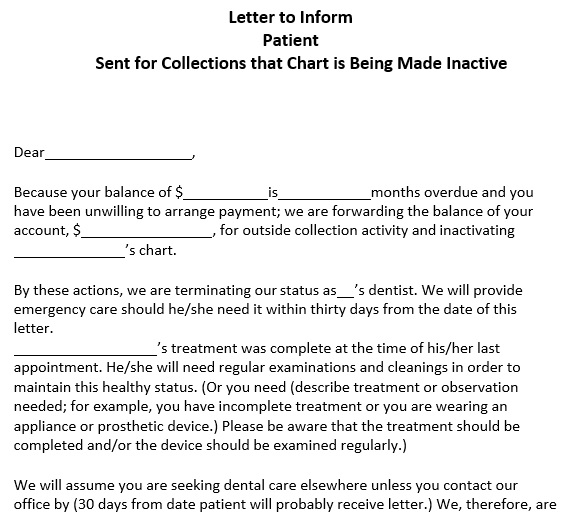

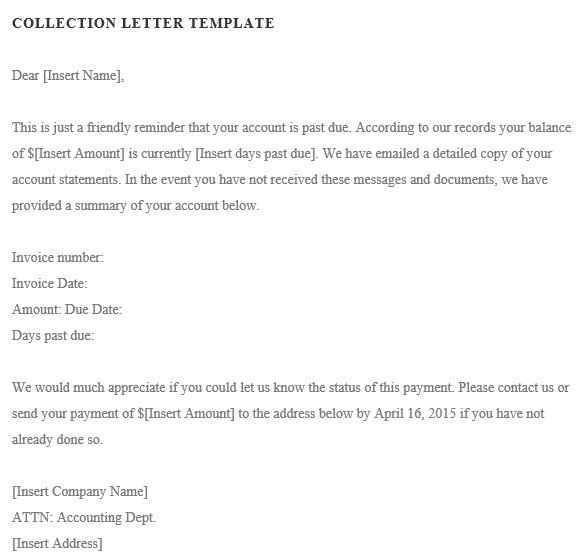

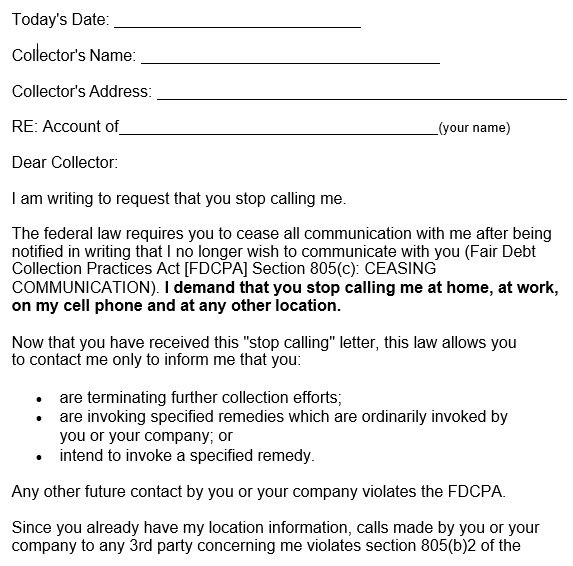

Fourth collection letter

When the need of sending this letter arise then it indicates that the customer either isn’t able or isn’t willing to pay what he owes. You have to use more assertive language in this letter but still remain professional. Furthermore, send this fourth one through certified mail just like the third letter.

Some features of a collection letter template:

Collection letter has some unique features that are mentioned below;

Objective:

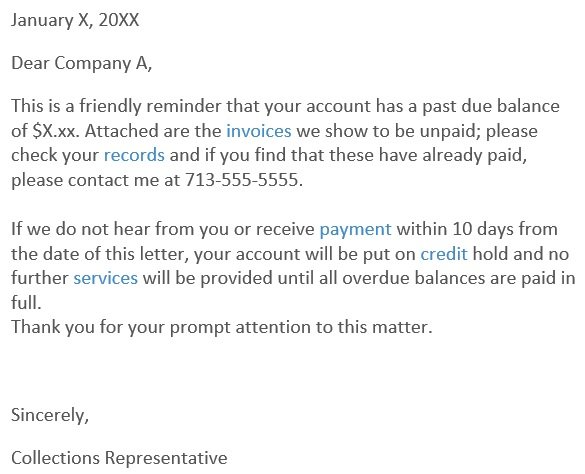

The main objective of composing this letter is to remind the customer that they owe a debt and they have to pay it before the deadline.

A reference to the previous letter:

Indicate a reference to the previous letter that you have sent to the customer while drafting the second, third, and fourth letters.

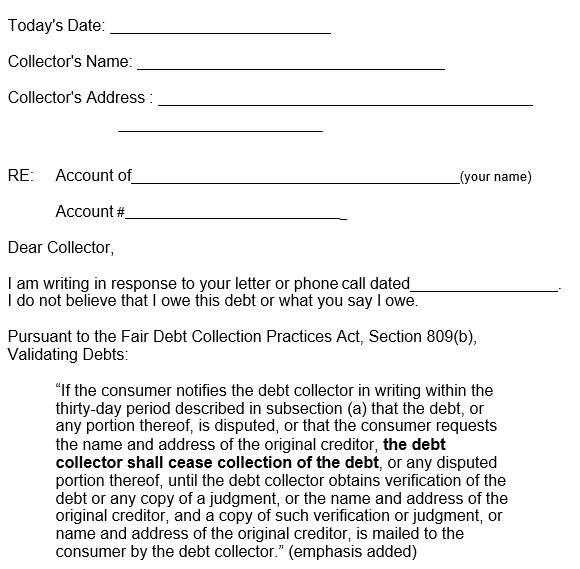

A warning for legal action:

This feature applies to the fourth letter. When the customers ignore the first three letters, the last one would have warning for the customer. This letter informs him that if he doesn’t respond or make the payment, you will take legal action against him.

The included parties:

The buyer and the seller are the parties included in this letter. The letter is composed by the latter. It is then sent to the former for the collection of dues.

The commanding principle:

By keeping the clients with the company, this refers to the collection of payment.

Your choice of language:

To convey your message, you should use straightforward, effective, friendly, and professional language in the letter.

How to write a collection letter template?

You should consider the following tips if you are composing such a letter the first time;

Practice restraint and tact

You should select your words carefully while reminding someone that he wasn’t able to make a payment or meet a financial commitment. This is because financial matters have a very sensitive nature. In terms of how the recipient will accept the message of your letter, practicing tact and restraint will go a long way. You just have to state the facts and inform the recipient of what he owes.

Always use a polite tone

For any kind of formal or business letter, you should always use a polite tone. Never use harsh or disrespectful language as a letter is a written document, the customer can use this against you.

Indicate to the customer that you understand his problems

Sometimes, customer isn’t able to make the payment due to financial issues. When you find this out, you should show your understanding in the letter. Both in writing your letter and in approaching the overall collection process, you should show some sensitivity.

In the process of writing collection letter templates, follow the steps

In the above section, we have discussed the different types of collection letters. In most cases, the first letter isn’t enough to convince the customer to make the payment. So, you have to compose the aforementioned series of letters. You should also check strong demand letters for payment.

Conclusion:

In conclusion, a collection letter template is an effective tool composed by the creditors for their debtors who haven’t made timely payments. The creditor would have to remind the customer if he isn’t able to make the payment on time. At first, the creditor tries to reach out to the debtor through email or by telephone but in case if he remains unsuccessful, he has to compose a collection letter.