A blank check or cheque often refers to a cheque signed by the authority before filling in the other information such as date, payee, and amount. So, a blank check template is used to design a blank check of a bank for the account holder.

There are several purposes of using a blank check. It’s helpful in businesses when is the person authorized for signing the check is taking leaves. So, the signing authorized trusts the blank check holder to fill in the blank checks as per requirement in his absence. Thus, the bank check template is helpful for businesses as well.

Though, it’s very risky and has very little control over the system. As the person having blank checks in hand can issues it to any person for any amount. Therefore, the blank check template is important to keep very safe in an encrypted format to avoid any monetary loss to the company. So, it must stay out of reach of unwanted persons. As anyone can fill in any information to withdraw the payment.

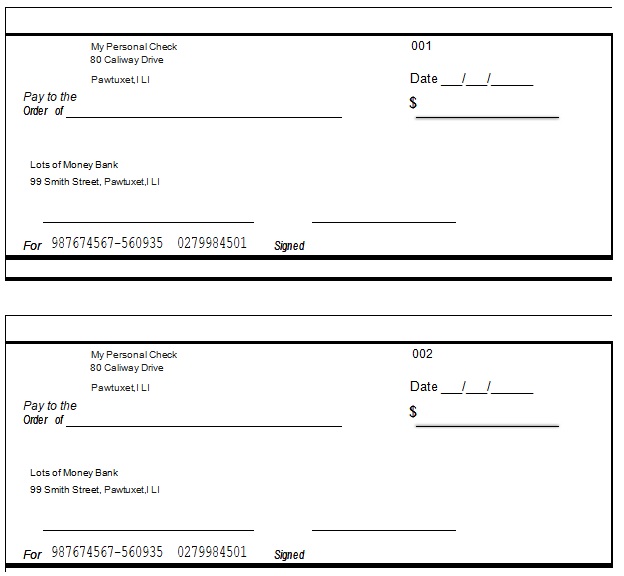

While sometimes, a blank check is also referred to as a new complete blank check that is just received from a bank as a new checkbook. These checks are completely blank and don’t even have a signature of an authorized person as in the case of another concept of a blank check.

So, the bank uses the blank check template to print the checkbook for its customers. Such type of blank check templates includes the information of the account holder in printed form. While the information of issuing the check is filled by the account holder for payments.

In companies, these blank check templates are inserted into the printer and all the payment details created in the computer using blank check templates are printed on the actual blank check.

Table of Contents

- 1 What is Blank Check?

- 2 Why do you require a blank check template?

- 3 Important components of blank check:

- 4 How to use blank check templates?

- 5 Main Types of Blank Check Template

- 6 Different kinds of blank checks:

- 7 Why do people still require paper checks?

- 8 How to write a blank check?

- 9 Advantages of paper checks:

- 10 Some important key points about bank checks:

- 11 Conclusion:

- 12 Frequently Asked Questions (FAQ)

What is Blank Check?

A blank check is a check that has been signed by an authorized signer but does not yet have the amount of money written on it. It shows sometimes that a large, uncertain amount has been authorized in order to achieve something.

Why do you require a blank check template?

Checks are important tool for major dealings understandably. This document is used to pay for insurance premiums. You can also use it in a first class restaurant to give payments to suppliers or pay for a really big and hearty meal. These are a few reasons that why you require a sufficient supply of checks on-hand.

In some cases, you’re down to your last check and you have to pay for something. Look no further than a check template in such a case. When the banks aren’t open and you need to sign a check at that moment, then the blank check templates prove very useful. Nowadays, people don’t want to keep substantial amounts of money at home. That’s why, it is the best option to have a blank check.

You can download a blank or personal check template with word options in order to simplify the process. You can download a blank or personal check template with word options in order to simplify the process. These blank checks serve different purpose. To play pranks on other people, you can even use a fake check template. They can also useful to teach your kids about checks and how to use them.

Blank check generators can generate pre-structured check formats. They have ready-made sections for the required information. Also, to generate checks for whatever reason you have, you can easily edit these checks with your own specific information. These check generators make your life easier as you don’t have to make the whole template yourself.

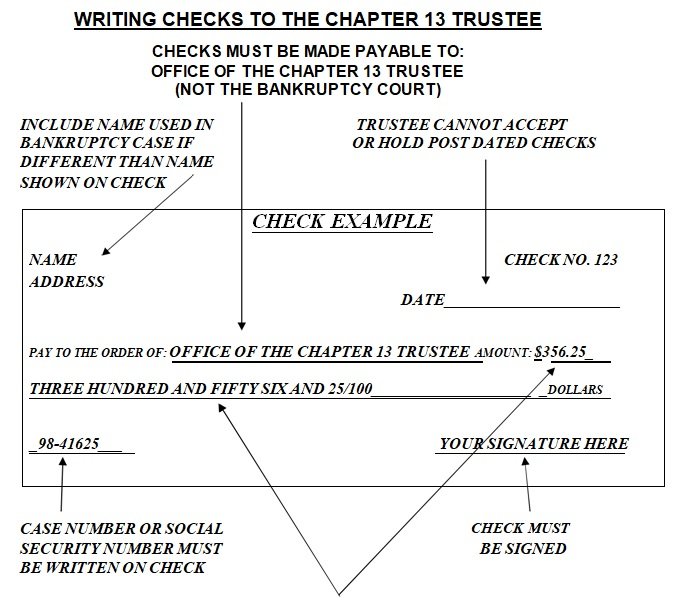

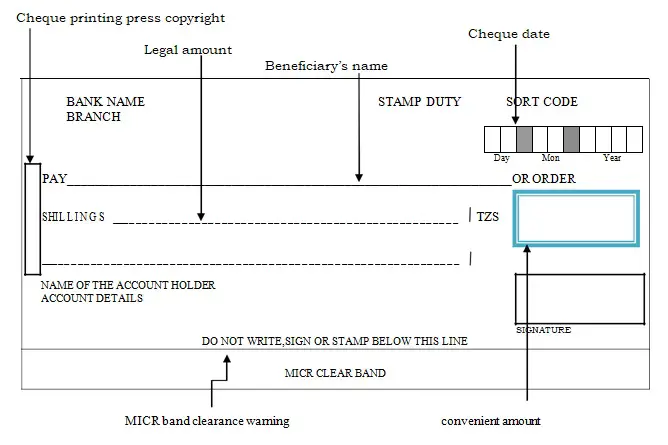

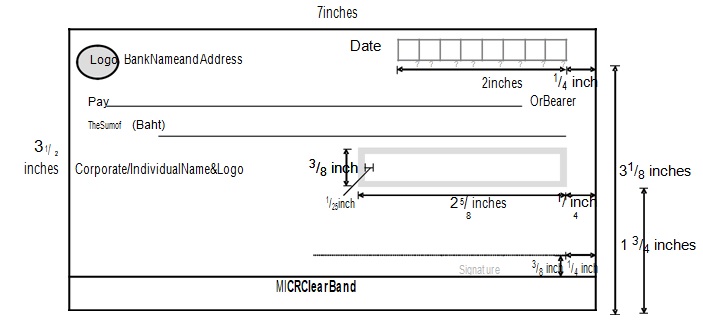

Important components of blank check:

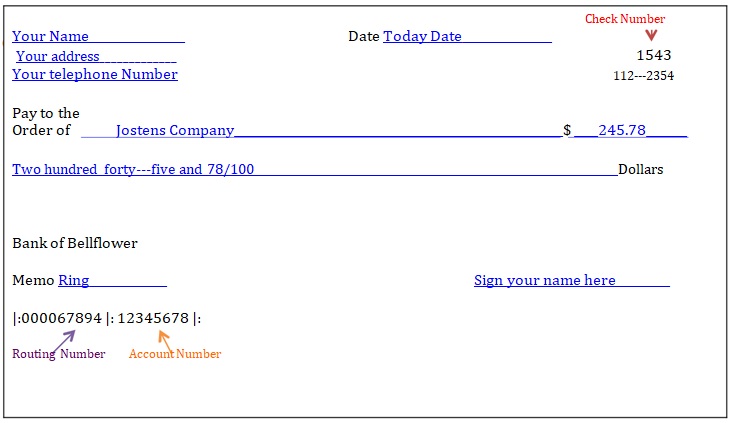

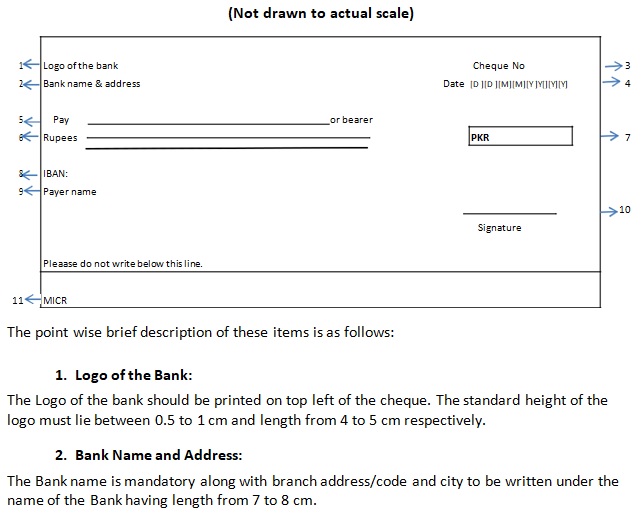

Let us discuss below the important elements that you must include in the blank check;

- At the top of your check, write the name of the bank.

- A dateline appears at the top right corner of the check, place the date here.

- Mention the name of the individual who is receiving the money. In case, you cashed by yourself, place your name.

- Amount in words.

- Amount in numeric form

- The most essential section of the check is the signature line. It serves as a permission document or authorization to release a certain amount of money. A signature line appears at the bottom right for the drawer’s signature in order to make it legal.

- Check number: this number assists you in keeping a record of your checks. This way, you can determine how many checks you are used for payment.

- Account number: it is issued by a bank for every customer. It is a unique code. It informs regarding the specific transaction of money such as withdraw or deposit against this account number.

- Routing number: on the left corner of the check, you can see the routing number. The routing number are the first nine digit codes. They also referred as region number.

- Drawer: this is the individual who writes the check.

How to use blank check templates?

At first, you have to select the fillable blank check template. Next, fill in the details. To get your own personal check, print this out. Edit the parts of the template’s design to make it look more original. Here are the tips that will help you to use blank checks more carefully;

- You should ensure to have the template approved for legal use first in case you intend to use check templates for any business transactions.

- For charity purposes or to provide as an award for one of your events, you can use oversized templates.

- There is a variety of blank templates you can select from in case you are looking to add special effects with your blank check.

- If you want to use the template to teach the children about banking processes, then you can use a specialized template for them. They contain simple layouts and big fonts. You just have to ensure that they aren’t meant for official use.

- You only require one template to produce as many check templates as you want or need.

- With clear and legible writing, fill up the checks.

- When sending your blank check by post, you should use a high-quality opaque envelope so that the contents will remain hidden.

- Before signing your check and sending it, you have to ensure that your bank account contains enough funds.

- Keep your blank checks in a safe and secure place.

Furthermore, there are a few things that you shouldn’t do while making or using check templates;

- Generating blank checks from templates isn’t wrong but you just have to ensure that when you use one, write the amount to pay right away.

- Don’t fold or pin your checks.

- Under the MICR field of your checks, never write anything.

Main Types of Blank Check Template

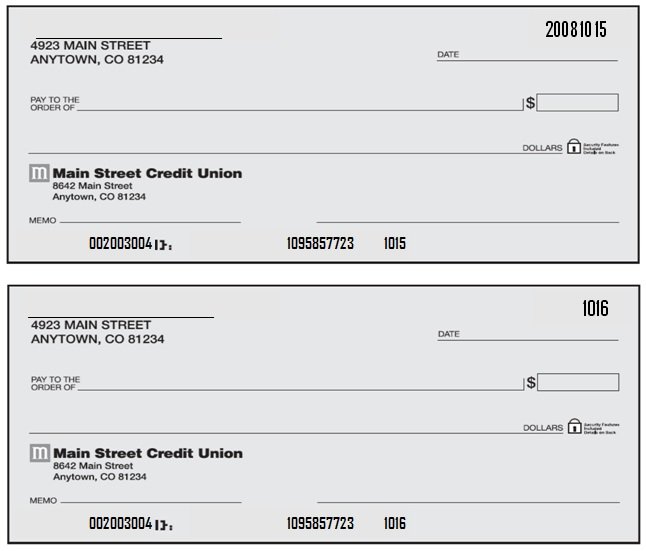

There three main types of blank check templates based on the application and concept of use. Two types are already explained in the above section. So, the summary of all three types of blank check templates is briefly described below.

The first type of blank check template is a template that already has the signature of authority and available to write any information about payment and person. While the stock of newly printed completely blank checks is the second type of blank check template which is also sometimes referred to as check stock.

Finally, the least common type of blank check template is a type of document that defined the name of the person and the signature of the authority. However, it doesn’t contain any value of the amount. These checks are used when an uncertain amount of money is being authorized to someone to accomplish something important.

For example, a company owner may give a blank check to a company research and development team to spend any amount of money to find a solution to the underlying challenge. Thus, the R&D team will be able to receive payment unless the task has been completed.

Different kinds of blank checks:

There are different kinds of blank checks which are as follows;

Bearer blank check:

When the bearer section present on a check isn’t canceled or marked then this check is known as a bear check. This check is payable by any person who presents it in the bank. However, this type of check is not safer but it is very helpful in some cases. In nature, the bearer blank check is risky.

Order blank check:

When the bearer present on the check is canceled or marked then this check is known as an order check. It is only cashed by the person whose name is mentioned on the check. No one can release money except the payee. Furthermore, this check is more secured than a bearer check because it is only cashed by the payee.

Crossed blank check:

When two parallel lines appear on the check, then the given check is known as a crossed check. The crossed check is not uncashed on the bank counter only the credit is shifted to the payee’s account.

Open blank check:

The open blank check is easily uncashed at the counter of bank.

Anti-dated blank check:

This type of check has a duration of three months to cash. If payees cash the check before the mentioned date on the check, then it is considered as an anti-dated check. Moreover, if this check isn’t cashed for three months then it becomes invalid.

Stale blank check:

A check is said to be a ‘stale check’ if it presented in the bank after three months. Also, it can’t be uncashed by the bank.

Why do people still require paper checks?

There are multiple reasons that why people still require paper checks. Some reasons are as under;

Reason#1:

In terms of security and management, checks are the best method of payment. Small businesses or organizations use checks for their payment rather than online. With the help of checks, you can keep a track of your payments. Furthermore, you can use different types of checks for different purposes. You can use paper checks for money transactions in small businesses such as insurance companies, hospitals, government offices, etc.

Reason#2:

If you use a different method of payment, then you have to pay a specific fee. Therefore, many small businesses or organizations use paper checks because using this method of payment doesn’t require any specific fee.

Reason#3:

Most importantly, it is useless for thieves. The check carries the name of a payee so it means it is only payable by the person whose name is mentioned on it. In case of misplacement, the finder isn’t able to encash it. You can also ask the bank to stop payment through checks. Hence, it’s a secure payment method.

Reason#4:

Next, it is the most suitable method to keep a track of your payments. A carbon copy of your check acts as evidence of your payments. In addition, paying bills with these checks is much easier than other means of payment.

How to write a blank check?

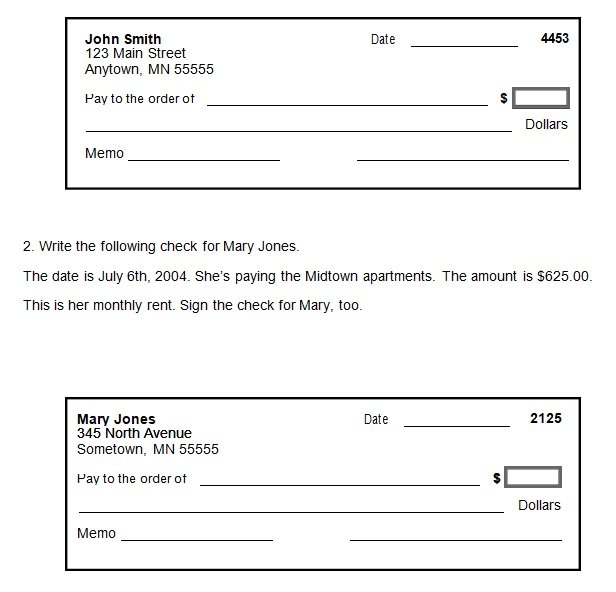

Here are the steps that you should follow while writing a blank check;

Current date

At the top-right part, write the current date. By having current date, you and the recipient can keep accurate records. Sometimes, you can use postdates but keep in mind that they don’t always work the way you intended them to be.

Name of the payee

This indicates the entity that you will provide the payment to. Ask if you don’t have idea about who you would make the check out to. You have to make sure the accuracy of this information.

Numeric amount

In the small box provided on the right-hand part, write the exact amount of your payment. Far over to the left, start writing this amount so all the words will fit.

Worded amount

You require this in order to avoid confusion and fraud. It refers to the official amount you pay. The amount in words will legally be the amount of your check if there be a discrepancy between the numeric amount and the amount in words. It is suggested to use all capital letters. This is because they are much harder to change.

Signature

On the line at the bottom-right part of the check, affix our signature legibly. You must use the same signature and name as mentioned on your bank’s file. This is an important requirement to make sure validity.

Advantages of paper checks:

Every payment method has various benefits so let us discuss the advantages of paper checks;

- It is the safest and most secure way of payment.

- It allows you to keep a track of your all payments.

- Paying bills with paper checks are much easier than any other method of payment.

- As the check is only payable by the person whose name is mentioned on it so it will be protected from thieves.

- Next, the carbon copy of your check proves the payment you have made.

Some important key points about bank checks:

- A check may be issued by someone who has a current bank account.

- You have to write the date when you signed the check.

- The check is valid only for three months or till the date written on it.

- Never create a bearer check.

Conclusion:

In conclusion, a blank check is the safest and easiest method of payment. There are also different types of blank check templates that you can easily download from any website. Also, these templates are perfect for any official bank.

Frequently Asked Questions (FAQ)

A blank check is a check that has been signed by an authorized signer but does not yet have the amount of money written on it. It shows sometimes that a large, uncertain amount has been authorized in order to achieve something.

No, it is not against the law. But the person whom you are giving a blank check can write any amount on it he desires and in the end, you would be stuck on it. Under American law, a blank check is considered to be an incomplete instrument. Without the authority of the signer writing an amount in a blank check is an ‘’alteration’’.

You can print a blank check with the help of Print Blank Check Wizard. Let us discuss step-by-step how to print a blank check;

Step#1: Go to the print menu and select the first option. Under the check tab, print blank checks on blank paper.

Step#2: Next, select the account from which you want to print checks under the Account name drop-down menu. Then, go to the checkbook section and enter the next check number in the respective field. If you want to make changes to the checkbook, click on the Edit checkbook button to open the checkbook information wizard.

Step#3: Enter the number of pages that you want to print in the ‘how many pages would you like to print’ field.

Step#4: Go to the Print Method section and select whether to print continuously or in booklet format. As they print check the decremented number to decrease checks the numbers. Furthermore, if you want to prevent the information of the account holder and the bank information from printing on the checks then check the respective boxes to check each option.

Step#5: In the end, verify that checks are print correctly or not. If any check didn’t print correctly clear the OK checkbox. This will enable you to reprint the checks without incrementing the check numbers. Click the Clear All or Mark All buttons respectively if you want to clear or recheck all checkboxes.

If your check has been stolen or lost then you first need to contact your bank. If the check has already cashed then ask your bank to put a stop payment on it. As it’s a formal request a check will not be cashed out by the bank if someone appears to be deposited or presented to cash it. You can request to stop payment either by calling your bank or visit a branch. Some banks also allow you to request it online. For stop payment, you have to provide a check number, the exact amount of the check, and which person made it out to. If you provide any of that information incorrectly then the check might still be cashed.

Writing a blank check means that the check has signed without any stated amount. It is also considered as an unrestricted authority or a free hand.