A self employment ledger template is a useful tool used to take note of all self-employment cash returns. In self-employment, a person works for himself rather than being employed by an employer who pays on basis of salaries. A self-employed person receives his or her income by performing profitable actions. A few examples of self-employed individuals are self-sufficient contractors, sole proprietors of businesses, etc.

Table of Contents

- 1 Why is it important to track your income and expenses?

- 2 Guidelines for completing the self employment ledger template:

- 3 Self-employment contracts:

- 4 Self-employment contracts and agreements:

- 5 Employee or Self-Employed

- 6 The significance of contracts

- 7 What to include in a self-employment ledger template?

- 8 Where do you find self-employment contracts?

- 9 Common law and employment agreements:

- 10 How to create a self-employment ledger?

- 11 Conclusion:

- 12 Faqs (Frequently Asked Questions)

Why is it important to track your income and expenses?

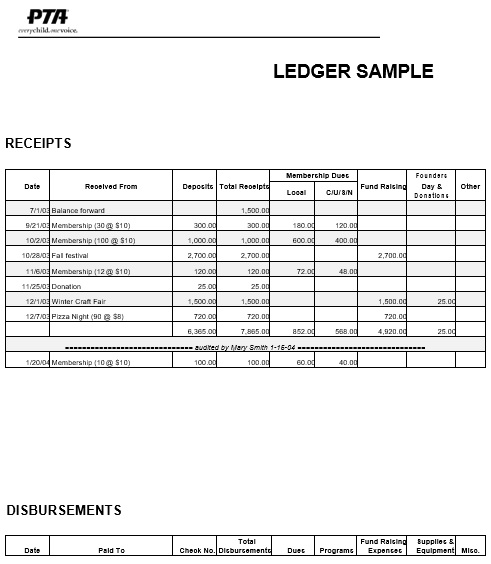

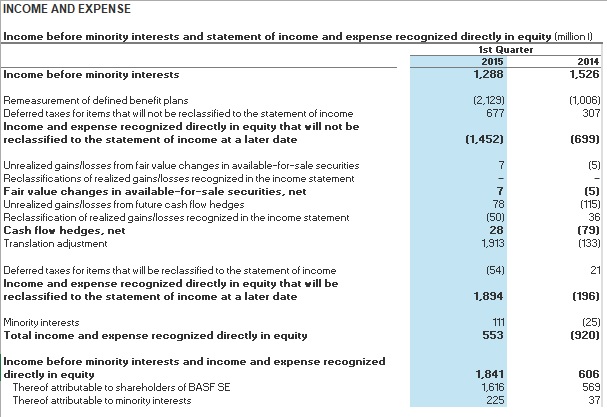

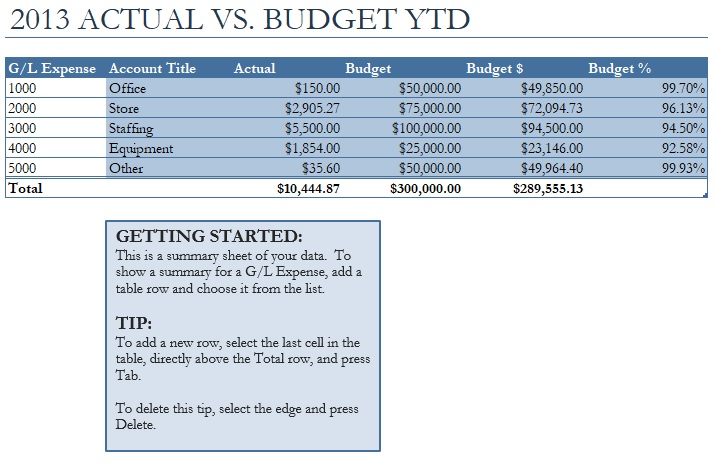

You can better manage your finances and optimize your tax refund by having a reliable self-employment ledger. When it comes down to tax season, it serves as proof of all your earnings and expenses. The process of filing taxes yourself or working with an accountant becomes much faster by having one organized place with all your expenses. Also, it saves you valuable time and money.

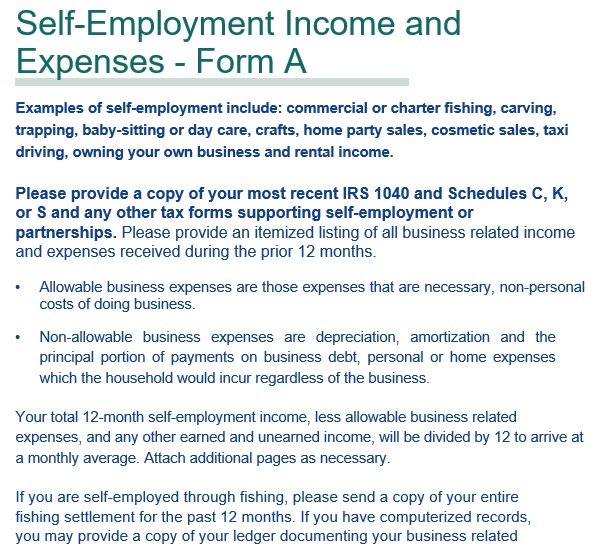

Guidelines for completing the self employment ledger template:

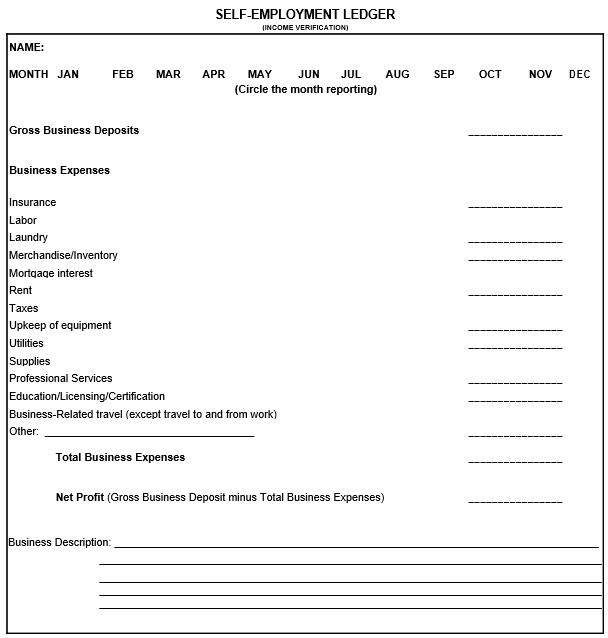

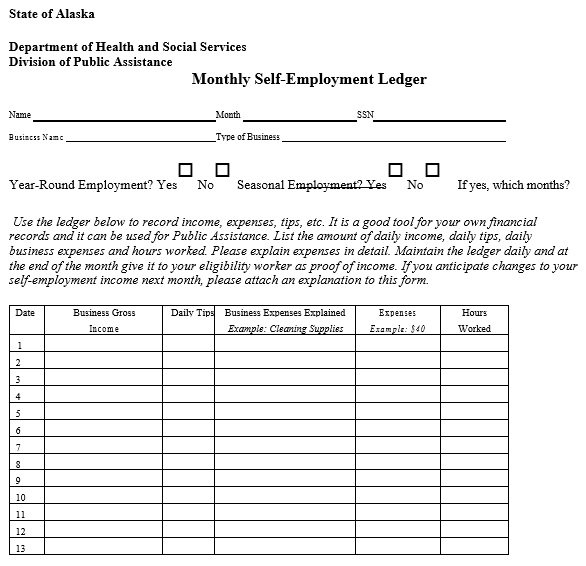

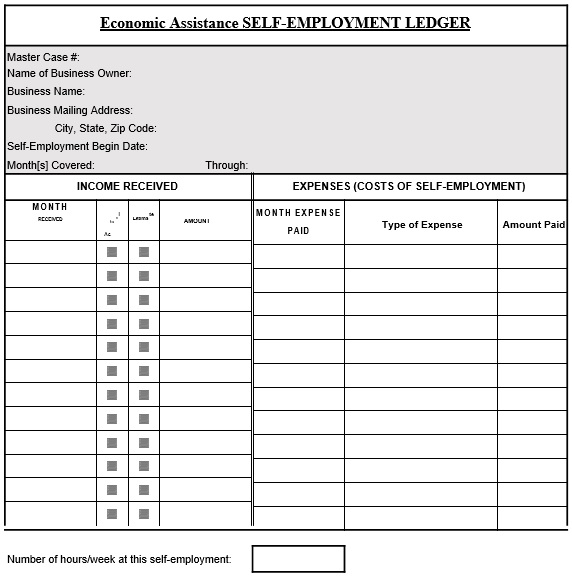

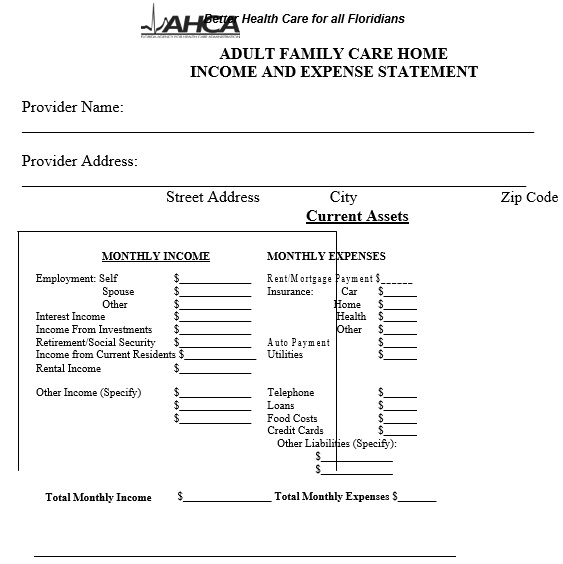

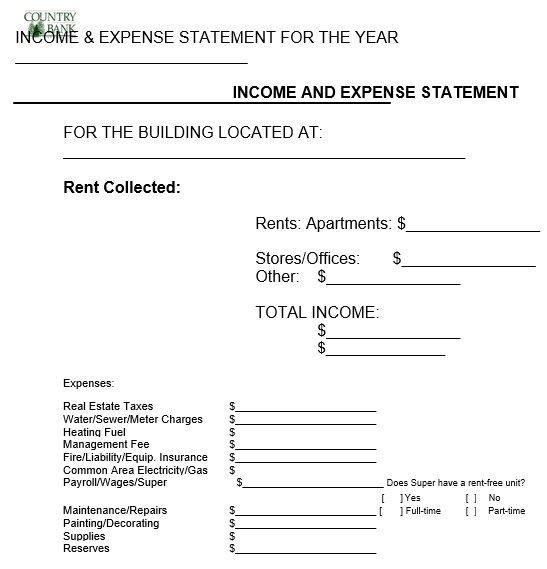

Gross income

Each month, all gross income amounts you gain, write them in an orderly manner. Instead of stating when the work was completed, you have to write when you received your income.

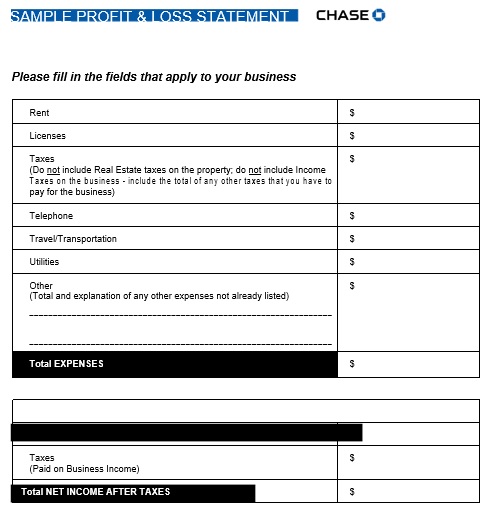

Expenses

For completing the self-employment ledger form, it is also important to write all accepted business expenses and monthly expenditures. From your self-employment income, accepted business expenses could be deducted. It usually contains payments on major purchases.

If your business is located in your domestic residence, then the alternatives you can choose for deductions are house insurance, home real estate taxes, or mortgage. You can decide to claim;

- For self-employment, a certain percentage of the real domestic expense as the “cost of doing business”

- Another percentage as subtraction in the SNAP budget

- The entire real housing price as a subtraction in the SNAP budget

Furthermore, for domestic-based self-employment premises, consumption expenditures are not accepted. But, telephone charges may be incurred that are business-related. When you are using your domestic house same as the locality of your business, you shouldn’t include the following in the expenses category of a ledger;

- Depleted items,

- Depreciation, taxes,

- Personal domestic expenditures,

- Your retirement plans,

- Private telephone and internet charges

- Consumption costs

Every self-business program has its own set of rules that define what an acceptable business is. For instance, the expenses that would be acceptable in one business program may not be applicable in another program.

Self-employment contracts:

There is a massive difference between privileges gained by individuals who are employed and who are self-employed. The biggest difference is that a self-employed individual is answerable for his or her own tax and national insurance deductions.

The self-employed individual doesn’t have an employment agreement. This is because they are employed for a short duration of time. This type of contract has regulations that based on the employer. These regulations may include the following;

- The complexity of the task at hand

- The rate of payment

- Duration of time given to complete each task

- The services offered

In addition, the means of communication widely used by self-employed individuals is verbal means of communication. It can be used in agreeing on the terms and conditions of a specific contract. But, written agreements are the best. This is because individuals can easily understand the precisely stated terms, services offered and expectations.

The rights of self-employed individuals are not basically secured by the rule of law. For self-employed individuals, it is important to ensure that they have been offered the duty of accomplishing the task and the agreement is well agreed on. These people are in a better position that allows them to easily control their time constraints and make decisions on whether they will accept the job or reject it and the pay.

Self-employment contracts and agreements:

Self-employed individuals widely use verbal communication as means of communication. The reason behind is that verbal agreement can be used in agreeing on the terms and conditions of a specific contract. But, written contracts are the best to use. This is because people can acquaint themselves with clearly and concisely stated terms, services offered and expectations easily.

Employee or Self-Employed

By the rule of law, the self-employed individual’s rights are not basically secured. Furthermore, employment common law secures the rights of employees as compared to those of self-employed individuals.

It is essential for self-employed people to ensure that they have been given the duty of accomplishing the task and the agreement is well agreed on. They are in a better position that makes them able to easily control their time constraints. Also, they make a decision on whether or not they will accept the job or reject it and the pay. They are also liable for their financiers. For paying taxes and national insurance policies, they have major responsibilities.

The significance of contracts

Self-employed individuals must have a piece of agreement that are well-written. The most essential thing regarding self-employment agreements is that they can possibly be used to as an agreement for services.

Additionally, they must have clauses like “no mutual obligations.” This indicates that there is no commitment for both parties to provide work, accept or reject work, and how to get your payment for a job done. The limitations or the eliminations managing the amount of work taken and how the work is supposed to be completed is an important clause that may also be part of this document. This is based on personal abilities to achieve the task taken on the agreed time frame.

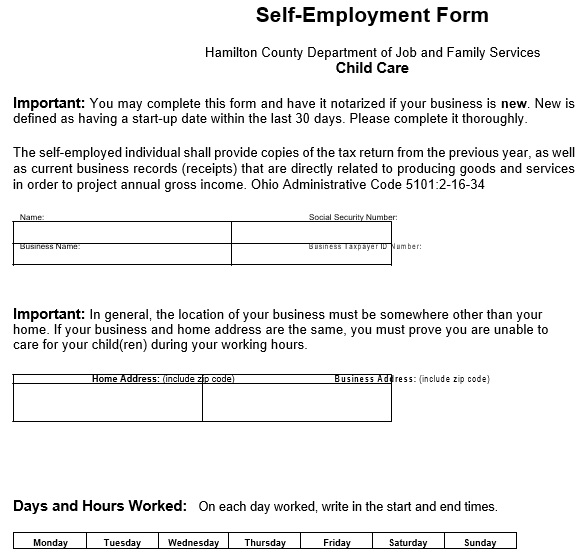

What to include in a self-employment ledger template?

The self-employment ledger template should include the following;

Name

Your name, the name of your business and your personal names should always be included. This is because you and your business are a similar entity. One cannot exist without the other.

Copies

Copies of this document are used to keep a record or the recently used self-employment ledger template even the canceled ones. Soft copies are the best since you can easily save them to your computer. But, you have to be in possession of a backup device such as a portable hard disk.

VAT

You have to take note of the dynamics of VAT rates. On your self-employment ledger template, specify whether you are VAT registered in order to have a clear understanding of VAT rates.

Invoice numbering

Your numbering should be consistent. It should be in an orderly sequence.

Tax Avenues

Your tax avenues should be included in your self-employment ledger template. It should not differ with the template’s date.

Payment terms

You have to think critically on the methods of payment. In case, you want to work with large companies or bigger clients then you must include terms of payment in your self-employment template. Before you decide to work on a certain project, you should make your payment terms right.

Bank details

Don’t forget to include your bank details on this important document. It is a main mistake that people find themselves doing.

International Trade

It is suggested to add his or her international trade only if he or she is VAT registered.

Order Number or Referencing

You should contact with your employers or clients about whether or not to include the “Purchase Order Number.” This will serve as a guide to your clients or individuals who hire you for your services. You can only use it to distribute your cost on certain projects, budgets, or total pricing at their end. You should make sure that your order number is right for purposes of avoiding too much delaying of payments.

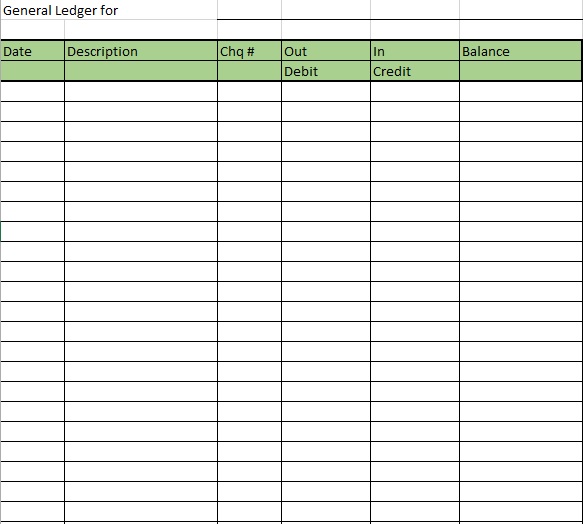

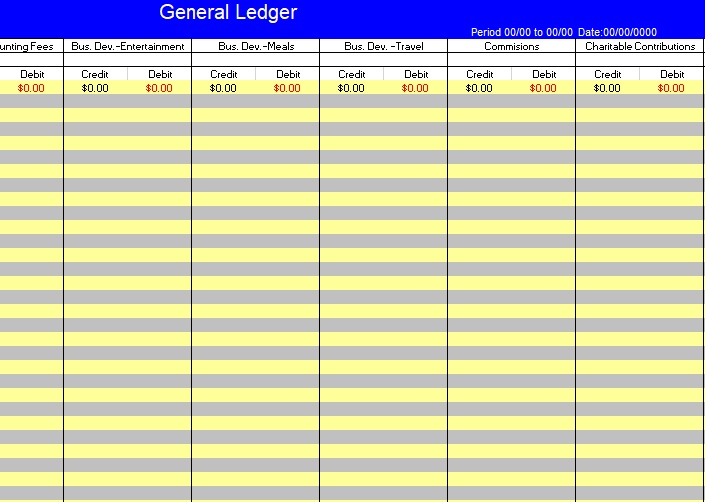

People use the services of online book-keeping systems such as Xero. If you don’t need the services of an online book-keeping system then you can list down the following important items in a ledger document;

- Details of work or project

- Client’s or employer’s name

- Amount total deductions and VAT

- Invoice date and number

- The date you received your payments

Where do you find self-employment contracts?

You can find self-employment contracts and self-employment ledger forms or templates on various websites. They are already written agreements. You can download them for personal utility, but keep in mind that they charge a specific amount of money for every download.

It is very essential for self-employment people to invest in financial that will help you in making your personal contract. You can ask for help on how to formulate a personal business contract or seek help from any government or private financial advisers in case you have to be in a position to identify someone who runs a self-employed business.

The properly formulated self-employment ledger templates significance should be kept into consideration as self-employed individuals have little legal employment rights compared. Moreover, they have a large number of financial hazards like fraud than ordinary employees.

These documents have services and expectations that prove very useful for self-employed individuals and the people hiring them. So, there is an existence of an employment agreement between the person offering the work and the person willing to accomplish the work in case one accepts to complete a specific task. No matter whether the agreement is written or was verbally communicated.

Common law and employment agreements:

In the world, every country has its own unique laws that secure the rights of employees. The law has strict rules and regulations. All these control employment contracts and the rights of each and every employee. These are referred to as statutory rights. Each employee is entitled to these rights. They have to be mentioned in each and every employment agreement. But, when it comes to matters relevant to self-employment, these rights differ.

How to create a self-employment ledger?

Here are some tips to consider while making a self-employment ledger;

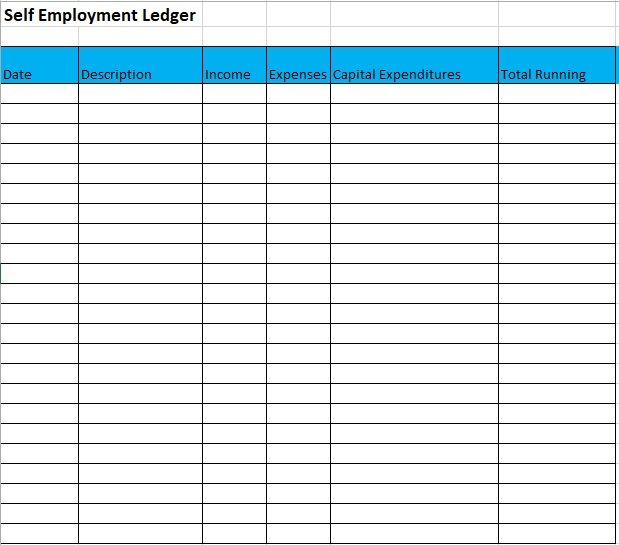

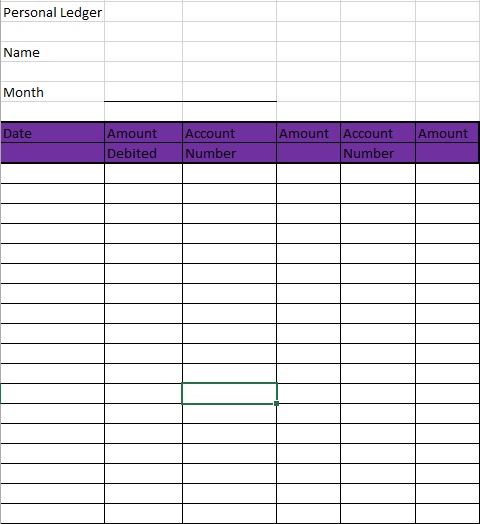

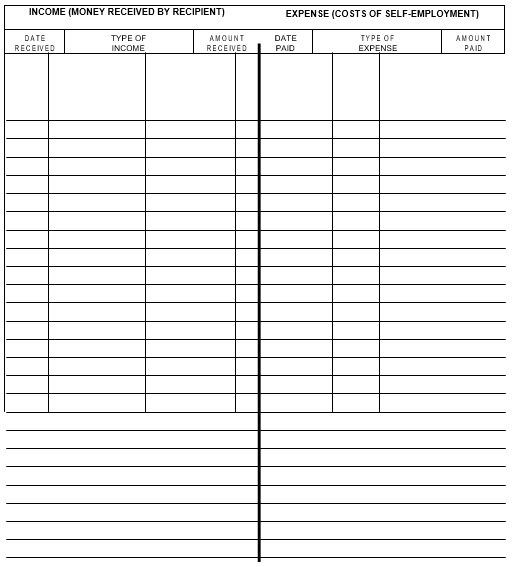

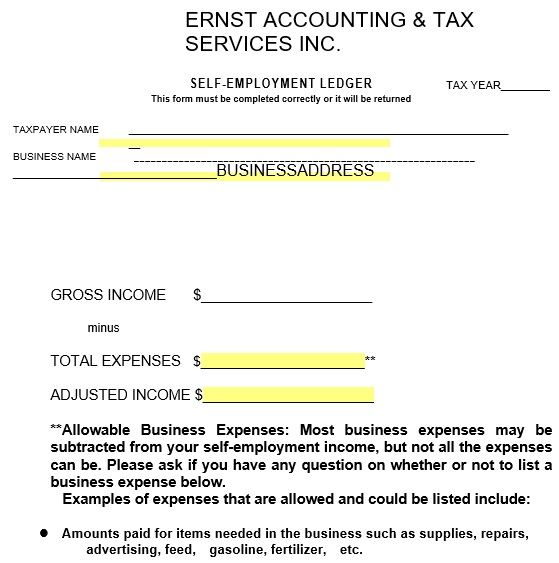

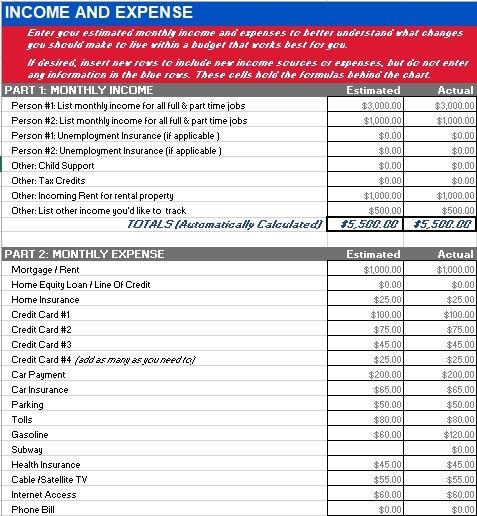

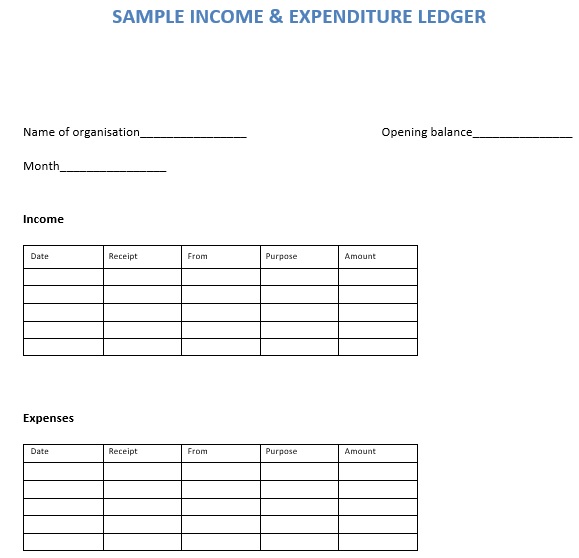

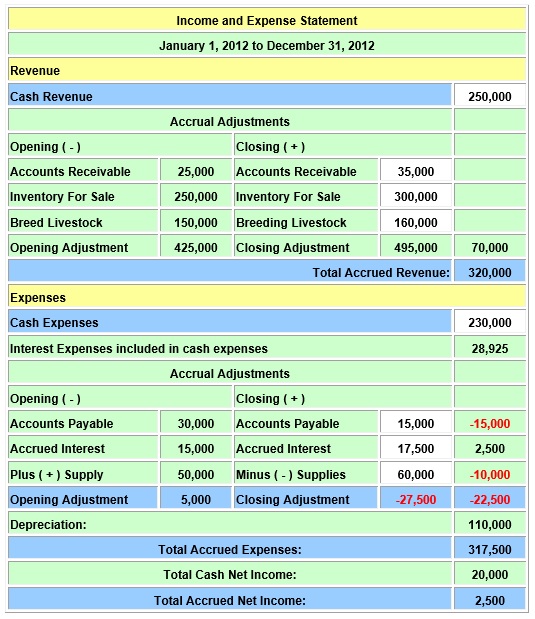

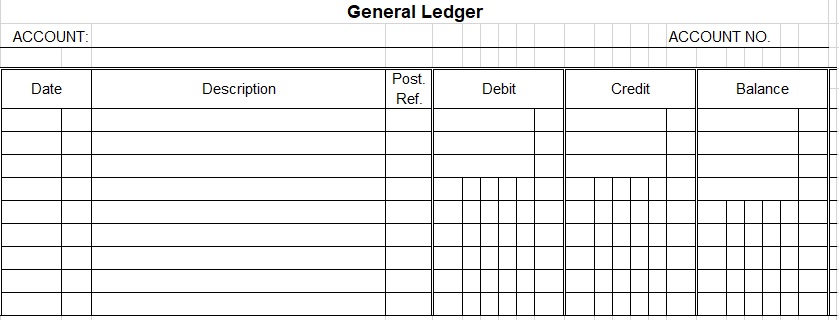

Make use of tables and spreadsheets

Using rows and columns as well as spreadsheet cells are the best way to present your detailed income and expenses. You just have to make sure that are inserting enough numbers of rows and columns for every detail to disclose in your ledger. The date, amount, and remarks are some of the details to include.

Include your personal information

Most self-employment ledgers just include a table for the financial details of the user. But, there must be another column for your personal information so that the marketplace easily recognize and archive your documents as yours. Also, they will not mismatch or miss it as someone else’s submission. You can state some of the details above the table such as complete legal name, company or brand name that you are using, address, and contact details.

Remain honest

You have to remain honest about what you are declaring. If you won’t provide accurate data and information then the Marketplace can’t cater to your preferences and can’t determine your limitations.

Conclusion:

In conclusion, a self-employment ledger template is a ledger document that indicates to employers or clients your details of cash returns. You can also find various self-employment templates on various websites.

Faqs (Frequently Asked Questions)

The main purpose of self-employment ledger is to prove that an individual is self-employed and is supporting himself only without signing an employment contract with another party.

No, there is not a particular format for creating this ledger. You just have to ensure that your ledger will look professional and must be well-organized. If you want to add some designs into your ledger then use only a maximum of three colors.

Making a list of the amounts based on what you can remember from the past months is the best way to make estimations of your income and expenses for your self-employment ledger. For your income estimates, you just have to list every client you’ve had, their payments, and then sum up all. While, for your expense estimates, list your basic necessities and miscellaneous expenditure as well as travel expenses and then add them up.