A mileage log template is commonly used by salespeople, service workers, or anyone who spends a significant time on the road. They use this tool to keep meticulous records of their driving. The IRS demands this document when you are claiming deductions on your tax returns.

Furthermore, using a mileage log template is the easiest way to record your mileage for each trip you take. It simplifies the task of keeping a record of your driving in order. Employees also use this log for collecting reimbursement from an employer.

Table of Contents

- 1 What is a mileage log?

- 2 The elements of a mileage log:

- 3 The types of qualified business driving:

- 4 Download Free Printable Mileage Log Templates

- 5 How can I create a mileage log in MS Excel?

- 6 The unqualified mileage:

- 7 Why should you keep a mileage log?

- 8 Some tips to track mileage:

- 9 What are the benefits of a digital mileage log?

- 10 Frequently Asked Questions (FAQ)

What is a mileage log?

A mileage log is a meticulous record of the vehicle that how many miles did it travel for the business over a certain period. It could be kept in a spreadsheet, form, logbook, or online application form. It is used for claiming a tax deduction or gathering reimbursement from your employer.

The elements of a mileage log:

Just like at the beginning of the year, you need a beginning record of the vehicle’s mileage, similarly, you also need a record at the end of the year too. This record should match with the amounts that are recorded every day to make sure that the mileage is accurate. Each time you begin your drive to a destination associated with business, you have to record the following information;

- The business trip’s date

- The trip’s starting point such as the office or job site.

- For your trip, the ending destination.

- The reason for your trip.

- On the vehicle, starting mileage.

- For that trip, ending mileage.

- On the trip, tolls and other costs.

Every trip must be recorded and at the end of the day, record the beginning and ending mileage to make sure that they are precise. The IRS also needs that after you use them for deductions, you keep these records on file for three years.

The types of qualified business driving:

Driving between offices or work sites

The mileage you drive between one work site and the next, you can deduct it. You can deduct the mileage between each as a business driving expense in case you spend your time between two offices.

Errands and supply stops

You can deduct from your taxes each year if you drive to the bank, post office or supply store. When you’re making these side trips on a daily basis, the miles can add up quickly. In case, you are a contractor who requires to load the truck with supplies, then this deduction can be included too.

Business entertainment

You can deduct the mileage for the trips when you meet with a client over coffee or head to dinner with a potential new client.

Airport travel

You can deduct the miles as expenses when you drive to the airport for trips. The return trip from the airport can be deducted too after your business trip.

Income can be qualified as a business from babysitting, landscaping, and concierge jobs. Therefore, you have to track the mileage to these jobs as a business expense.

Temporary job sites

Before moving on to others, contractors and other workers can usually spend less than a year at specific locations. When you drive to these temporary job sites, you can qualify for mileage deductions.

Seeking new employment

You can deduct the miles you drive to interviews if you are looking for a new job in your current industry. In a new industry, this isn’t true for a new position.

Customer visits

If you are meeting with customers at their office or job site, the standard mileage deduction can apply to times.

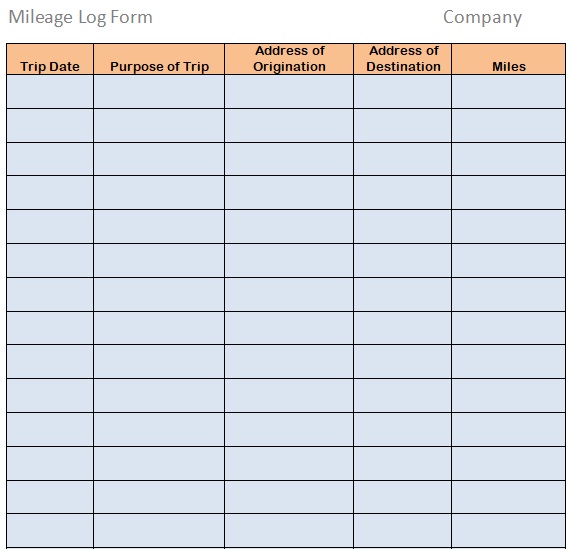

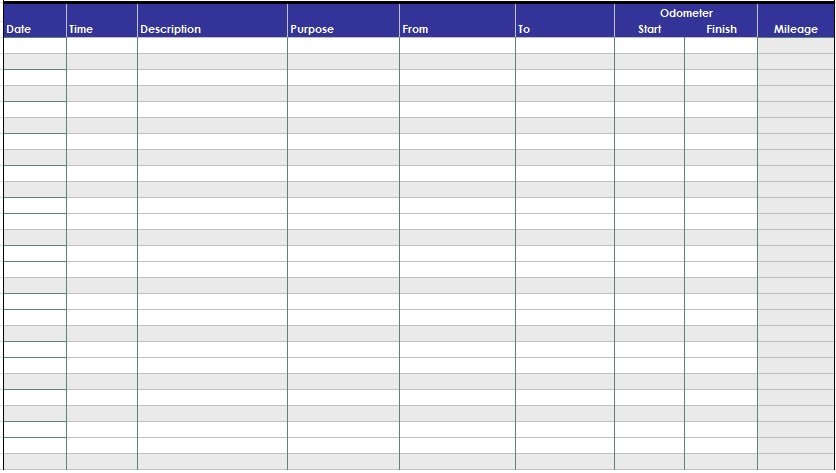

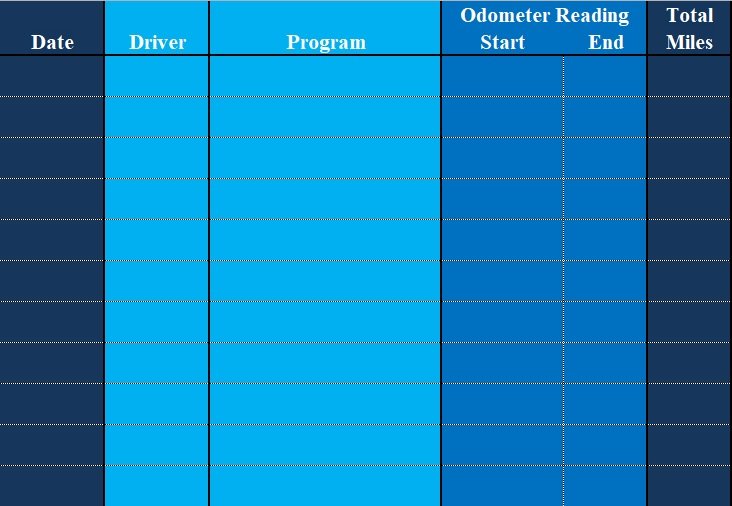

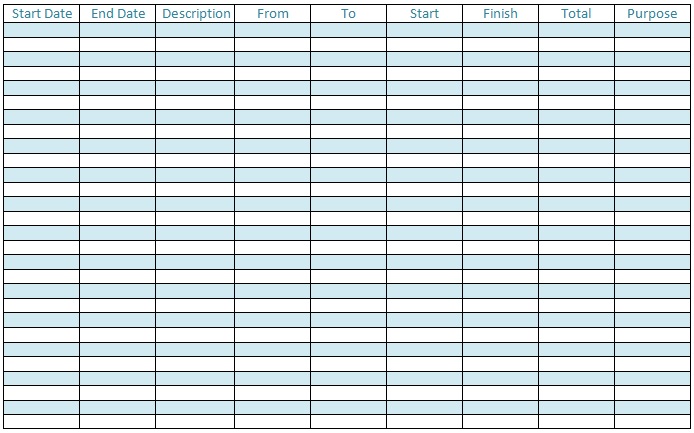

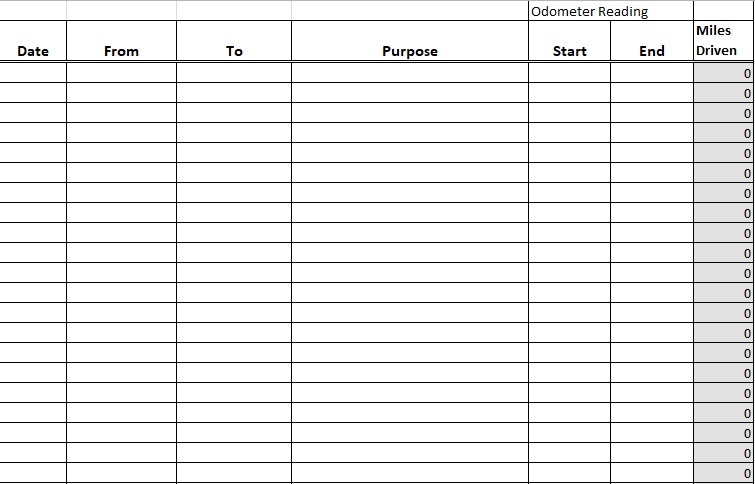

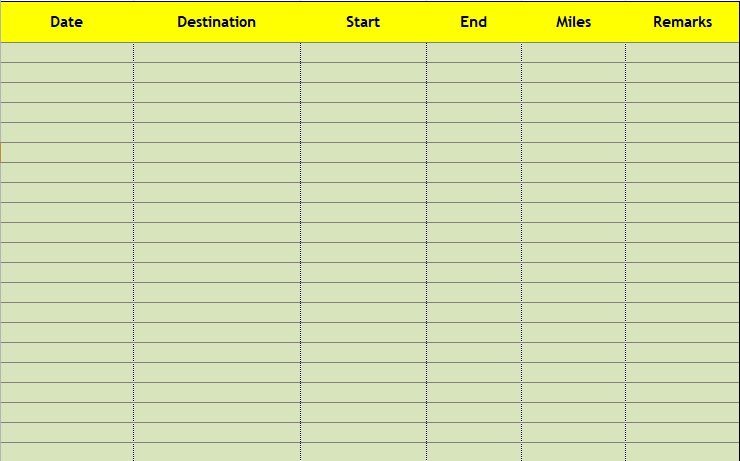

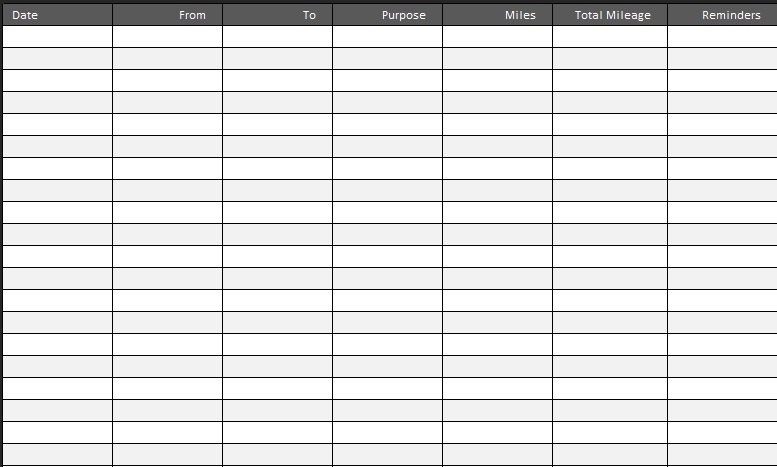

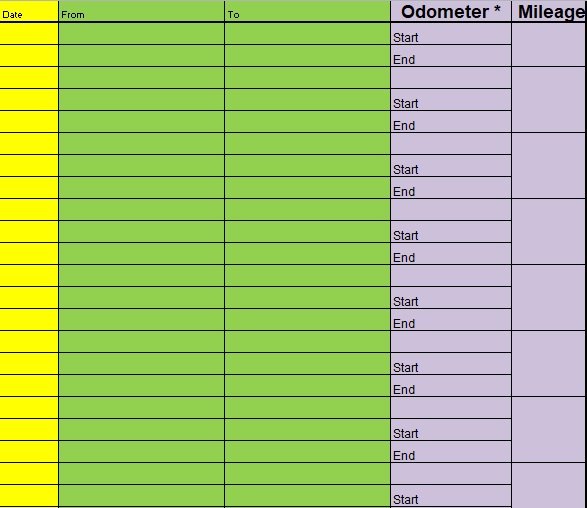

Download Free Printable Mileage Log Templates

How can I create a mileage log in MS Excel?

Let us discuss step-by-step how you can create a mileage log in MS Excel;

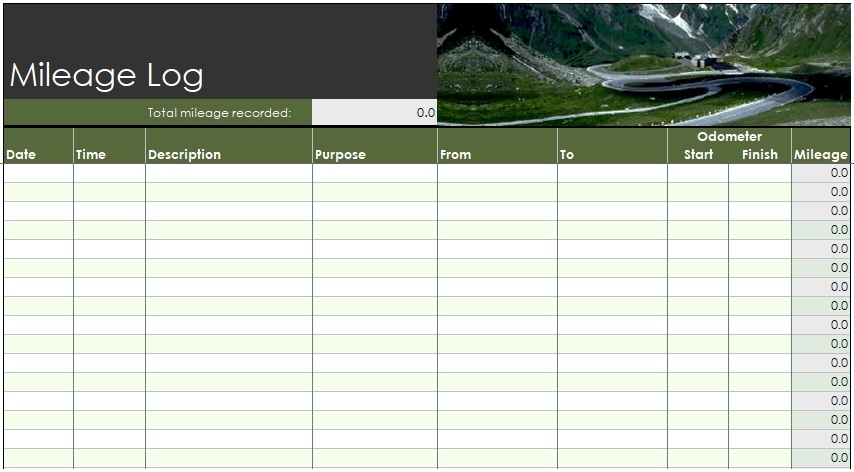

- Open the MS excel on your desktop screen. Then, click on the ‘file’ and select ‘new’ and search ‘mileage’ in the research box, and then press enter. Next, click the ‘template’ and have a look at the templates, select the template that you want to use. Click on the ‘create’ to open a new workbook.

- When a new workbook appeared with the template that you choose enter the detailed information about your trip. It contains multiple columns in which you add all the important information related to your trips such as the date, location you traveled to and from, time, and other details.

- Almost all the templates have separate columns for odometer readings where you can calculate your mileage for each trip based on the difference between of the two columns’ values.

- If you want to add other travel costs such as meals, automotive expenses, and lodging then insert a new column. Then, right-click the column next to which you want to add columns and then select ‘insert’.

- If you want to change the theme of the worksheet, click on the ‘page layout’ tab and select the different colors or font themes that you like and then change the color and font in the worksheet.

- Some templates don’t do the calculations of reimbursement. Enter the mileage rate in one cell and select the cell in which you display the reimbursement amount and click inside the formula bar.

Enter the formula= cell containing mileage- cell containing rate - You can calculate the other expenses if needed.

The unqualified mileage:

Commuting

When you have to commute from your home to your work location, the IRS considers it a personal expense. Your office or permanent place of business can be that work location. It is considered a place of business if you have a temporary location that you expect to work at least one year and the IRS won’t enable you to deduct that mileage.

If people use their commuting time to make business calls or listen to business-related recordings, they believe that they can take the deduction. Those miles are still referred commuting. Furthermore, they are noted as personal expenses.

It is considered your primary location for business if you work from home. The trips are considered business expenses that taken from the home office to a client meeting or to run errands.

Mistakes that people make

Creating the log in a batch for the whole month or year. It is essential that the mileage log is done regularly. The IRS needs meticulous records. They need all the details that we have discussed above such as the date and reason for the trip as well as mileage information for each trip.

Missing information

For each trip, when the IRS wants the reason then they must accompany a name or business account. You have to include the name of the client in your log if you claim to be reviewing a client’s account at his office. For missing or incorrect information, many business owners have been denied their deductions.

Calculating deductions

For business mileage expenses, there are generally two options to calculate deductions. The first one is the standard mileage deduction or the second one is actual expenses for the vehicle.

You’re adding up the total miles per year that are driven for business for the standard mileage deduction. For each of those miles, you will take a preset deduction. The deduction is 54 cents for each mile in 2016. You can’t include repairs or maintenance to the vehicle by using this standard.

You have to have a precise record of all maintenance and repairs done on the vehicle in case you plan to deduct actual expenses. The mileage percentage on the vehicle is deducted from the costs on your taxes for business.

No matter what kind of deduction you are choosing at the end of the year. You have to keep precise records of your mileage throughout the entire year along with other information such as names, dates and reasons for the trips. Your business mileage tracking becomes easier with the help of mileage log template.

Why should you keep a mileage log?

You should keep a mileage log in order to deduct mileage on taxes and claim back the money that you spend on business travel. Provide sufficient proof to the IRS for entitled deductions by documenting your deductible miles properly. This way, you can also avoid a possible tax audit.

Some tips to track mileage:

Consider the following tips to track mileage effectively;

- If you want to keep your mileage records accurate and detailed then calculate them daily. This is particularly important if you are audited.

- Mileage apps can have errors so use maps as a backup. In case, you forget or lose the mileage information, you can check the route with an online map to estimate the miles traveled.

- According to the IRS, you should keep mileage logs and other relevant documentation for at least three years. Thus, keep digital versions in a safe and easily accessible location to make sure that records aren’t lost.

- You must keep a paper copy of your mileage log in your vehicle. It serves as a backup if technology fails.

What are the benefits of a digital mileage log?

If you travel to work, you can use mileage reports to save money on taxes. It is important to keep a mileage journal as you know how quickly miles may accumulate. Let us discuss below the main benefits of a digital mileage log;

Improves financial record

It is an outdated approach to keep track of miles on paper and ink. Additionally, you can’t accurately record the number of miles traveled through this method.

A Google Sheets mileage log template enables you to check your log anytime and anywhere. All your record is kept in the cloud because you don’t have to be concerned about data loss.

Saves time

With Google Sheets, you can track miles easily just in a few minutes. Thus, you have to spend less time manually tracking miles so you have enough time to concentrate on expanding your business.

Help avoid audits

Business cost reimbursement is taken extremely seriously by the IRS. When they call for details, many people don’t have their handwritten mileage diaries at that time. The IRS may decide to audit you as these deductions are notoriously inaccurate. They may also not accept your company mileage expense. Hence, you can check your log anytime and anywhere with a digital mileage log.

Frequently Asked Questions (FAQ)

For tax purposes, mileage tracking requirements are very limited by IRS (internal revenue service). In mileage logging, you have to enlist the mileage of each trip for each vehicle. For claiming mileage, IRS has eligibility requirements like the type of business.

During the personal use of vehicles, you can’t claim the mileage. It can be confusing for fleet drivers as they take vehicles home every day. You have to make a difference between the miles that you put for work and commuting miles. With the mileage, you should also record the trip date, trip mileage, business purpose, and location you traveled to and from.

A long time ago, you had to always keep a notebook and pen with you for tracking mileage. But now we live in a modern where there is an app for everything. Also, there are a lot of apps such as Hurdlr, Stride, trip log, etc. that track mileage for you.