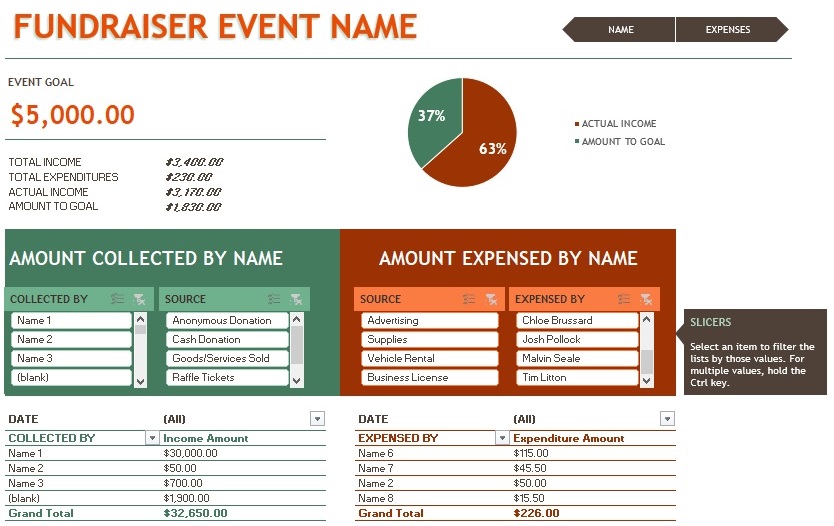

A donation tracker template is used by non-profit organizations to keep track of all the donations coming in. These organizations provide relief and assistance for those in need by hosting fundraising events and campaigns. The donations are collected from willing benefactors.

Moreover, there are different kinds of non-profit organizations but they have equally important causes. They pay attention to the environment, social issues, and others. They usually have a goal in mind while hosting an event to raise funding. Also, they use donation charts and a fundraising tracker template to monitor the progress of the funds coming in. These tools make sure that all the money is well-spent. You should also check Non-Profit Donation Receipt Templates.

Table of Contents

What is a donation tracker?

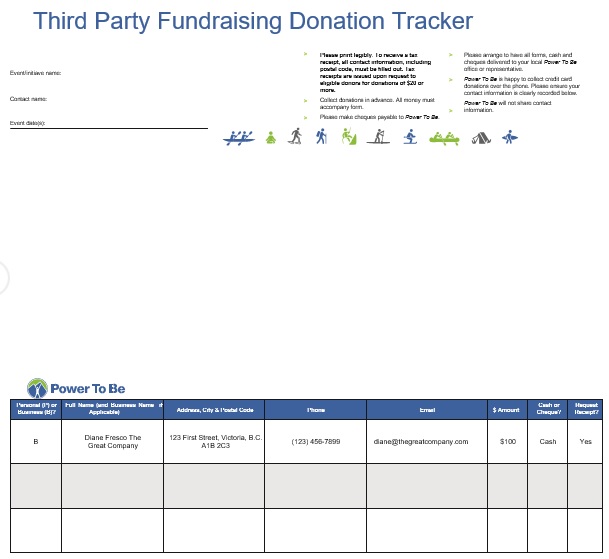

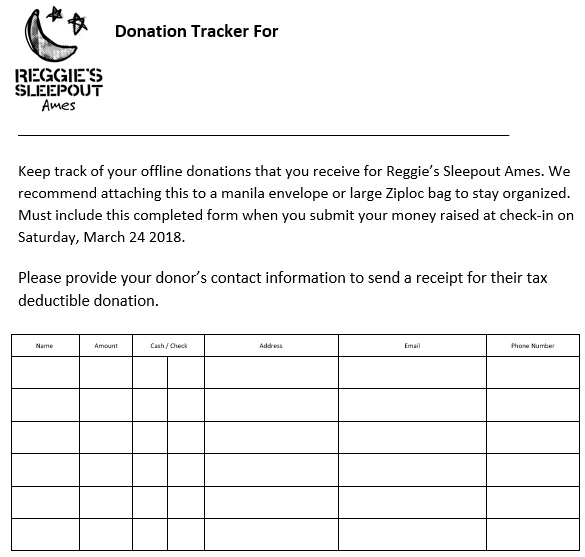

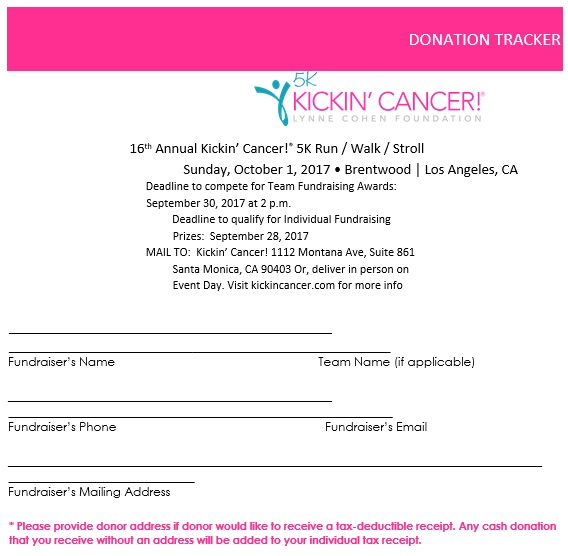

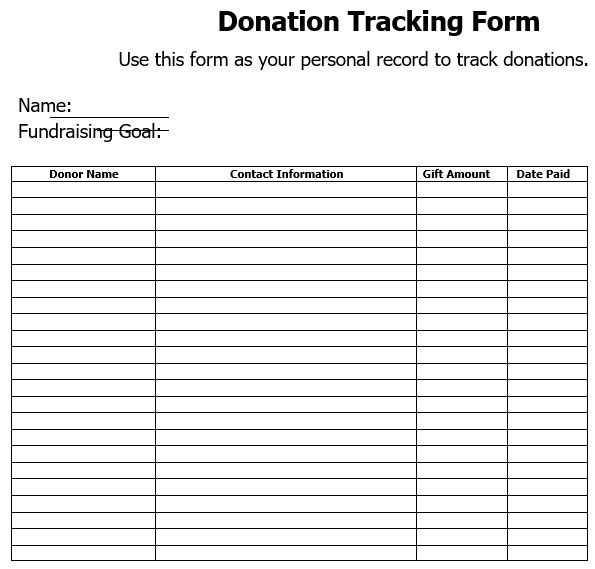

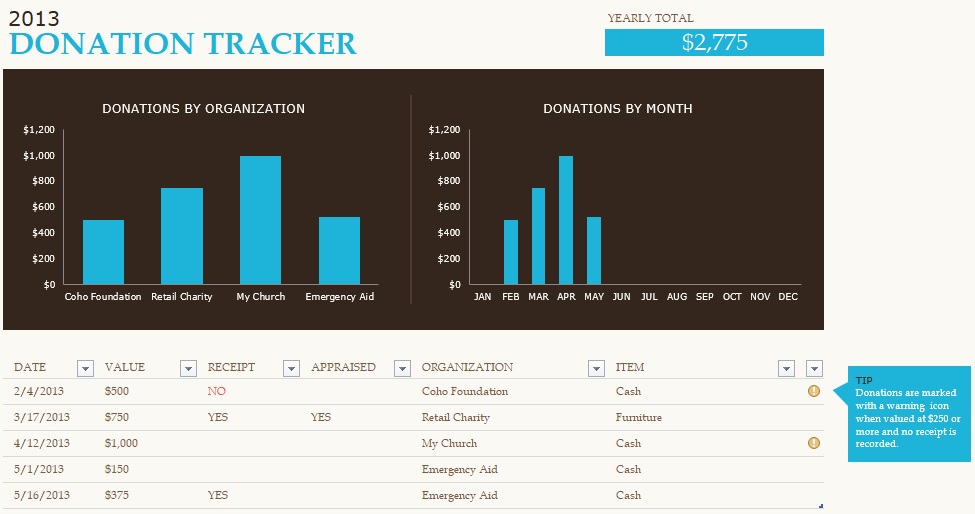

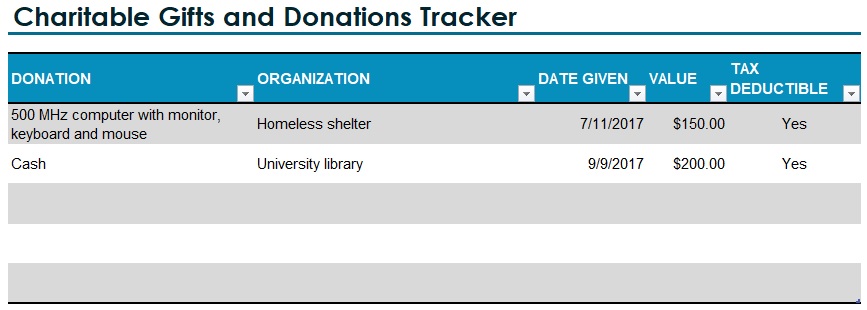

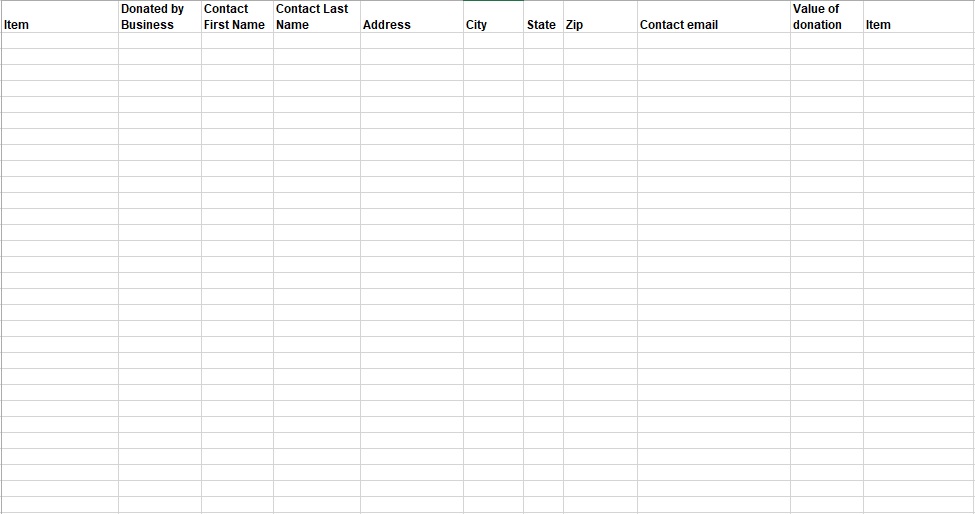

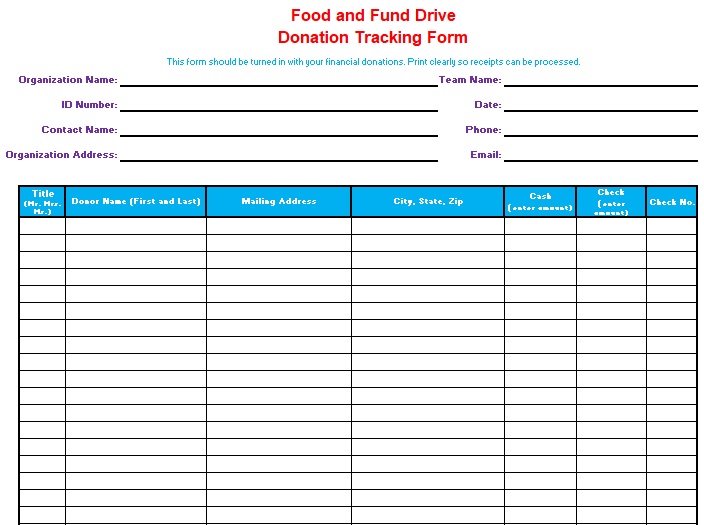

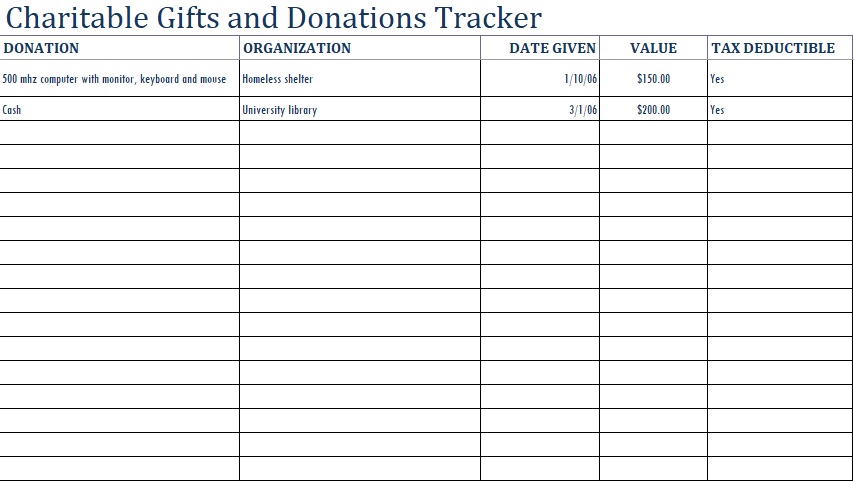

As its name implies, it is basically a tool used to track funds or donations. The donation tracker contains the important details. It includes who donated, type of donation, the date of donation, and many more. They are used in any fundraising or charitable event to monitor charitable gifts. This way, you can see whether you have calculated the right amount or not.

The key components of a donation tracker:

You should include the following components in your donation tracker in order to make it informative;

Title

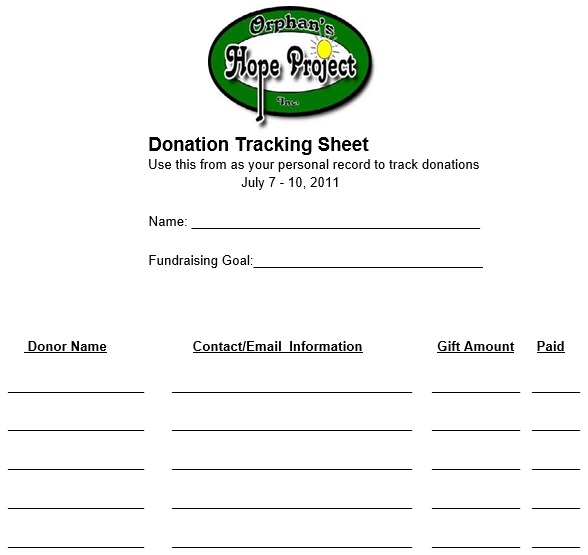

The title of your donation tracker should be at the right and it must contain the words ‘Donation Tracker’. Your title states the purpose of your document. People may not realize the importance of your sheet without an effective title.

Information of the fundraiser

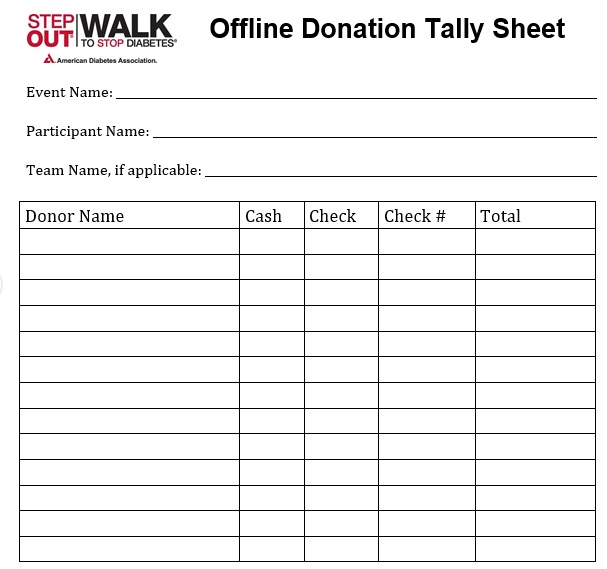

You must have to include the fundraiser information in your sheet. This basically an entity or nonprofit organization who gets the donations to work on their causes. In this section, you have to state the fundraiser’s name, address, and contact details as well as nonprofit’s branding and purpose of the event.

Name of the donor

Donor’s name is the most important detail in the donation tracker. To acknowledge the donation, it is essential to write the name of the donor. Since donors donated with a same purpose to your cause, you must provide your thanks to them.

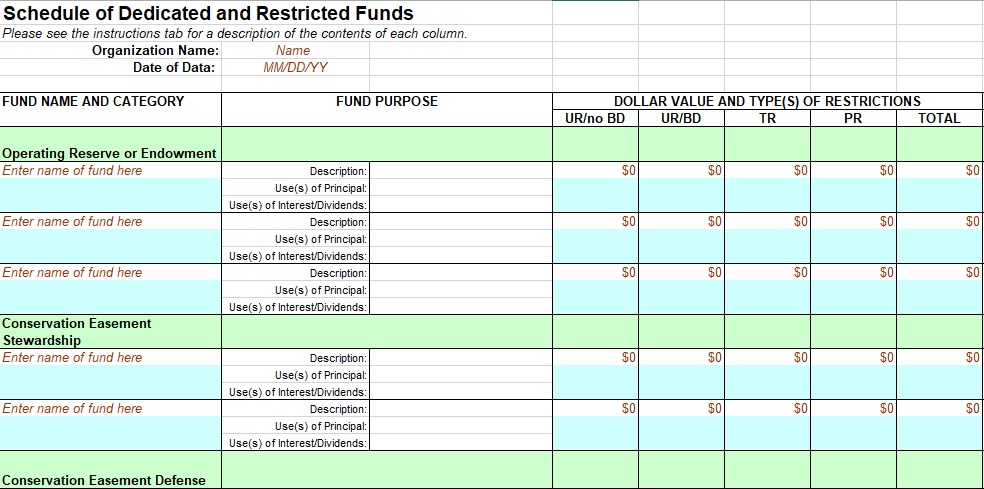

Amount of donation

Likewise donor’s name, the amount of donation is also important element of a donation tracker. There is no need to write down all the donation payments and gifts. In case of monetary gifts, specify the full amount given. On the other hand, in case of nonmonetary gifts, you have to specify the value of gifts for recordkeeping purpose.

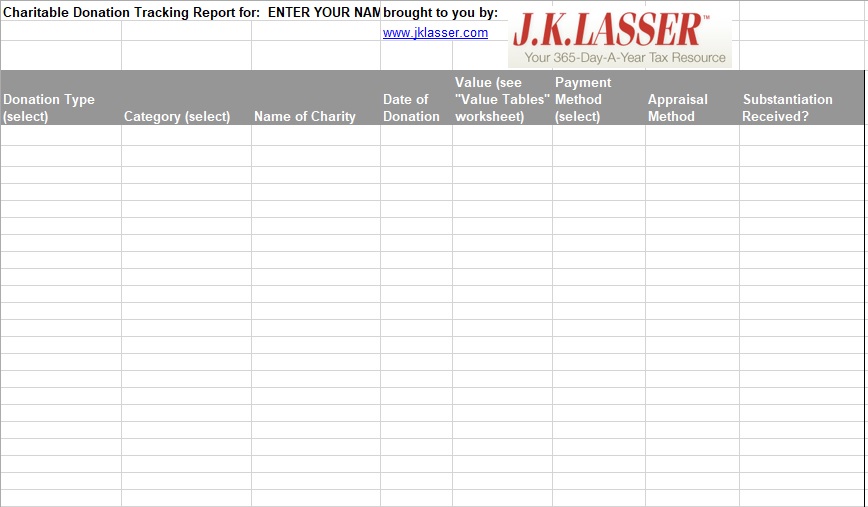

Donation method

Likewise payment method, donation method indicates whether the payment was made in cash, debit, or any other method. Explaining payment method is important as people may want to know about how they received such funds.

Donation date

The date of donation is another important element due to monitoring purpose. You have to provide the exact timeframe of when the donation was done including time and date. In case, donations were made several times then specify all dates. In such a way, it becomes easier for you to track the donations as per the chronological order.

Donor’s address

When you want to send donors an acknowledgment letter or to clarify particular donation information then you may have to track the whereabouts’ of the donors. So, you must state the physical address in the donation tracker.

Contact details of the donor

You must include the contact number, email address, or any other contact details of the donor in your document. These details prove very useful in case the physical address of the donor is inconvenient at the moment.

Notes

In your donation tracker, leave a space for notes to use it for many purposes such as to calculate the next donation budget, updating the data, and more.

Benefits of a donation tracker:

Nowadays, giving donations is very common and is already part of our way of life. You can start using a donation or fundraising tracker if you want to check all the donations you receive. Let us discuss below the benefits of using such trackers;

- When you give donations, you will feel wonderful. It will make you feel good too when you think that how you affect a person’s life in a good way. Your experience becomes more special and real by knowing where your donation goes. You will keep track of where your donations go by using a tracker. You can record your donations in the tracker whether you donate money or goods.

- By giving to charities, you will get a chance to connect with the people in need. You will become worldlier by tracking all the donations you’ve given. This way, you will also see the exact situations of the people or societies you donate to. This will assist you in understanding the lives of the underprivileged better.

- In order to get exemptions on your taxes, you can also use the tracker. The tracker will act as a concrete document of all the donations you gathered and gave away. In addition to this, you may get an opportunity to waive-off taxes and get some exemptions. Therefore, it is very helpful to keep such a document. All the donations that have made within a year, you can use it to summarize them. After that, along with all your donation tracking documents, you can submit your summary. These will serve as evidence of all the charitable work you’ve done throughout the year.

- A donation tracker is also easy to make and easy to use. They are very helpful tools that you can customize as per your requirements. You may use this document in case you work in an organization that hosts a lot of fundraising events. You can either use a donation chart, tracker or even a fundraiser thermometer template as all of these serve the same purpose and provide the same benefits.

How to track donations?

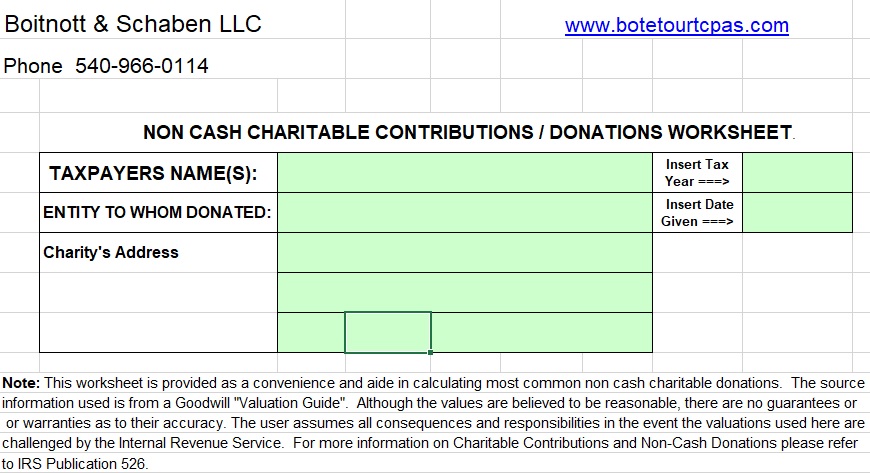

A donation tracker or a donation chart can be used for different purposes. The most essential purpose is to get tax exemptions. You need to document everything in case you’ve made charitable contributions. Do this so that you will be well-prepared when the time for paying taxes comes.

Furthermore, before start tracking donations, you should first identify which ones you need to document. Then, you have to make a decision what type of template to use. For tracking that works for your own organization, develop a system. You also have to organize all your processes so that you can keep track of all the receiving donations.

- Not all donations can assist you in gaining tax exemptions. It is basically possible to get a tax deduction or exemption. Therefore, you should make a donation to a qualified charitable organization.

A charitable organization has to apply to the IRS in order to get qualified. Before you make your donation, ask the organization if they’re qualified first. - You also need the right documents when you have verified the qualification of the organization. On your own or through the organization, you can keep track of your donations. Rules regarding giving donations may vary from one organization to another.

- You can provide cash donations in various ways. You can provide cash or a check. Moreover, you can also use your credit or debit card. You need to record everything in your tracker even for cash donations. Write down your organization’s name, the date, and the amount of your donation.

- You may also have to keep additional documents along with your tracker. A bank record or statement is such a document that indicates how much you’ve contributed.

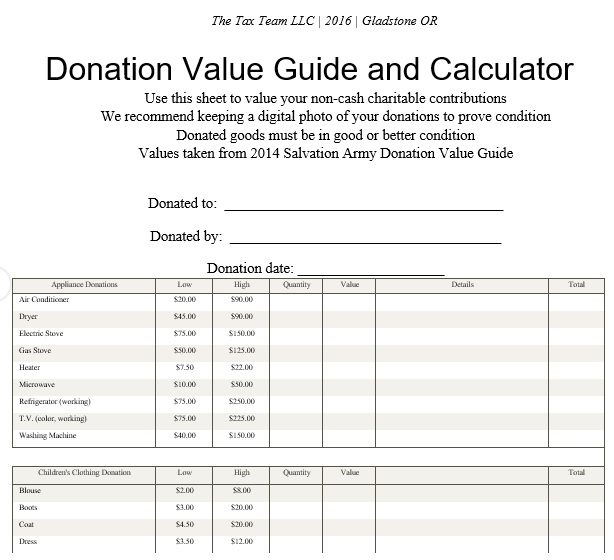

- It is more complex to keep track of non-cash donations. But, you still have to track all these contributions. For example, you have provided clothing or appliances to a charitable organization. You may also ask for documentation for this. This is based on the value of the item you gave.

- In case, you want to track the items using their value, just evaluate them first. Consider what value a thrift store would charge for your item. You can record this value on your tracker.

- You have to make a contribution that’s less than $250. You require written confirmation for this from the organization. Attach this to your tracker to act as evidence of the donation.

- You may have to make a contribution of between $250 and $500 and also, and you also need a written acknowledgment for this from the organization. The document should also include a breakdown of the items you provided in case you donated items.

- You also need the above documents if the value of your contribution is between $500 and $5000. Aside from those, for the item/s you donated, you would also need a tax basis.

- Additionally, prepare the above documents if the value of your contribution is more than $5000. You will also require a written assessment of the property or items you have donated along with them. You may also see Donation Receipt Templates.

Conclusion:

In conclusion, a donation tracker template is a useful tool that allows you to visualize the amount you’ve collected. It will also assist you in organizing the donations while you’re going to spend them or give them away.

Faq (Frequently Asked Questions)

You must bear in mind that there are different rules for documenting donations whether it is cash or property. But, you can generally accept cash donations through check, credit card, or bank under $250 anytime. In case, donation is greater than $250 then you must have to send an acknowledgment to the donor.

The donations that are difficult to track include donated services, in-kind gifts, and noncash donations. However, it doesn’t indicate that you can’t track them, they are just challenging to record.

Here are some tips that you can follow;

1- Make a clear and realistic fundraising goal.

2- You must have sufficient information about your donor.

3- It is advisable to market your cause to the society.

4- On daily basis, track your fundraising progress.

There are some challenges that you may face while donating. These may include the following;

1- The high donor expectations

2- Funding cuts

3- Competition

4- Lack of resources

5- Distrust of fundraisers

6- Lack of cause